Wire transfer confirmation numbers explained

Wire transfer confirmation number: everything you need to know

Michelle Artreche

9 minutes

Education

Jan 28, 2026

Jan 28, 2026

You’ve just sent a $275,000 mortgage payoff wire. Three hours later, the lender calls asking where the money is.

There’s no confirmation email. No tracking number in your inbox. No easy way to prove where the funds are or even confirm they’re moving. Your client is anxious. Your team is scrambling. And you’re stuck in the uncomfortable gap between “we sent it” and “we can prove it.”

For many title professionals, this moment is familiar. After clicking send, wires can feel like they disappear into a black hole. Clients ask, “Where’s my money?” and too often, the honest answer is that you’re still waiting for clarity.

That’s where wire transfer confirmation numbers come in. Before getting into how to use them, it helps to understand exactly what a confirmation number is and what role it plays in a wire transfer.

Every wire transfer automatically receives a confirmation number. Firms that effectively prevent fraud and reduce risk understand how to find these numbers, verify them correctly, and document them consistently.

This guide explains what wire confirmation numbers are, the different types used in practice, where to find them, how to verify wires step-by-step, and how confirmation numbers help manage risk without fully protecting against fraud on their own.

What is a wire transfer confirmation number?

A wire transfer confirmation number is a unique identifier assigned by a bank or payment network when a wire transfer is sent or received. It works a lot like a tracking number for money and gives you a way to follow a wire after it has been initiated.

Every legitimate wire transfer receives a confirmation number automatically. This is standard banking practice, whether the wire is domestic or international, incoming or outgoing.

Confirmation numbers are valuable because they:

- Prove a wire was initiated and entered into the banking system

- Allow banks to trace a wire’s status

- Create an official audit trail for compliance, disputes, and investigations

What a confirmation number is not

To avoid confusion, it helps to understand what confirmation numbers do not represent:

- It is not a routing number. Routing numbers identify banks, not individual wire transfers.

- It is not an account number. Account numbers identify where funds are intended to go.

- It is not an internal file number or escrow reference. Confirmation numbers come from the banking network, not from your closing or accounting software.

Why one wire can have multiple confirmation numbers

Wire transfers move through payment networks such as Fedwire, CHIPS, or SWIFT. Because of that, a single wire transfer can generate more than one reference number along the way. You may see:

- A confirmation number created by the sending bank

- A confirmation number created by the receiving bank

- A reference generated by the payment network itself

Understanding which confirmation number you are looking at and which one you need for verification is an important part of tracking and confirming wire transfers accurately.

.png)

Types of wire transfer confirmation numbers

Not all confirmation numbers look the same. Different digital payment networks use different formats and naming conventions. Knowing which type you are dealing with makes it easier to verify wires correctly and avoid unnecessary delays.

Federal reference number (Fedwire)

This is the most common confirmation number for domestic U.S. wires.

- Used by the Fedwire network

- Typically 9 to 16 digits

- Often begins with the wire date

- Encountered in most payoffs, seller proceeds, and earnest money deposits

If you handle residential transactions in the U.S., this is the confirmation number you will see most often.

IMAD and OMAD numbers

These numbers track the same Fedwire transfer from opposite ends of the transaction.

- IMAD (Input Message Accountability Data): created by the sending bank

- OMAD (Output Message Accountability Data): created by the receiving bank

- Typically 8-character alphanumeric codes

IMAD numbers are used to verify outgoing wires, while OMAD numbers are used to confirm incoming funds. Knowing which one to request can save a lot of time when working with banks.

CHIPS sequence number (SSN)

This confirmation number is used by the Clearing House Interbank Payments System, also known as CHIPS.

- Numeric format

- More common in large commercial transactions

- Seen less frequently in residential closings

SWIFT UETR (Unique End-to-End Transaction Reference)

This reference is used for international wire transfers on the SWIFT network.

- 36-character alphanumeric code

- Follows ISO 20022 standards

- Common with foreign buyers, international sellers, or offshore entities

MT103 reference

The MT103 is a SWIFT message format used for international payments.

- Contains both confirmation data and payment instructions

- Often used as proof of transfer for international wires

Once you know which confirmation numbers you may encounter, the next step is knowing where to find them when you actually need them.

Where to find wire transfer confirmation numbers

Banks do not always send wire transfer confirmation numbers automatically. Waiting for one to arrive on its own can create unnecessary stress, especially when a transaction is time-sensitive. The safest approach is to take an active role in locating the confirmation number as soon as a wire is sent.

Bank receipts and transaction records

Many banks include the confirmation number on a wire receipt or transaction record, whether it is provided on paper or as a PDF.

The labeling is not always consistent, so the number may appear as a reference number, trace number, Fed reference, or transaction ID. Becoming familiar with your bank’s terminology makes it easier to find quickly.

Online banking portals

Online banking portals tend to display confirmation numbers under sections like wire activity or transaction history. In some systems, the number appears immediately after the wire is submitted. In others, it shows up once the transaction processes. Taking time to learn where your bank displays this information can save time later.

Email notifications

Some banks send confirmation numbers by email, while others do not or require notifications to be enabled. If no email arrives shortly after sending a wire, do not assume one is coming. Follow up directly with your bank instead.

Direct request from your bank

Calling your bank’s wire department or treasury services team is often the fastest way to get a confirmation number. With the wire date, amount, and beneficiary name, bank representatives can usually provide it right away and confirm the wire’s status.

Finding the confirmation number is an important step, but understanding what it actually confirms is just as important.

What wire transfer confirmation numbers prove (and what they don't)

Wire transfer confirmation numbers are important, but they are easy to misunderstand. In real estate transactions, they can create confusion about what has actually been confirmed and what still needs to be verified.

When used the right way, confirmation numbers add clarity and documentation. When relied on too heavily, they can create a false sense of comfort.

What wire transfer status confirmation numbers DO prove

A confirmation number proves that a wire transfer exists within the payment network and that it was successfully initiated. It creates an official record showing that the wire entered the banking system and allows banks to track its status, whether the transfer is pending, completed, or returned.

Confirmation numbers make it possible for banks to investigate issues and trace funds if something goes wrong. From a compliance standpoint, they provide documentation that supports internal records, audits, and insurance requirements. Without a confirmation number, banks have a very limited ability to help locate or recover funds.

What confirmation numbers DO NOT prove

At the same time, confirmation numbers have clear limitations. They do not confirm that funds were sent to the correct account. They do not guarantee that funds are immediately available. They also do not validate the identity of the recipient.

This matters because fraudsters frequently create fake wire receipts, screenshots, and PDFs that include realistic-looking confirmation numbers. In many business email compromise cases, forged confirmations are used to create urgency and push teams to move forward too quickly.

For that reason, confirmation numbers should be treated as one data point, not full proof that a transaction is safe or complete.

The verification gap in real estate closings

This misunderstanding shows up during closings. A buyer may send a screenshot showing a confirmation number for earnest money and claim the wire is complete. At that point, it can be tempting to move forward, especially when everyone is eager to close.

However, that documentation alone is not enough. The wire could still be pending, sent to the wrong account, or entirely fabricated. The safest step is independent verification with your own bank to confirm the funds have actually arrived in your escrow account before proceeding.

This is where having a clear, repeatable verification process makes a difference.

.png)

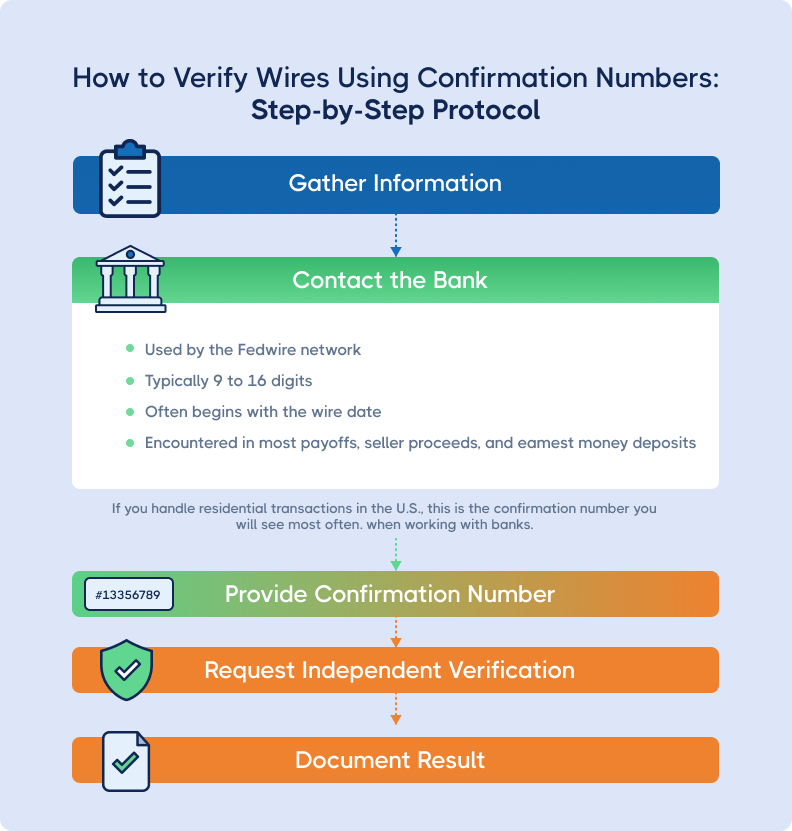

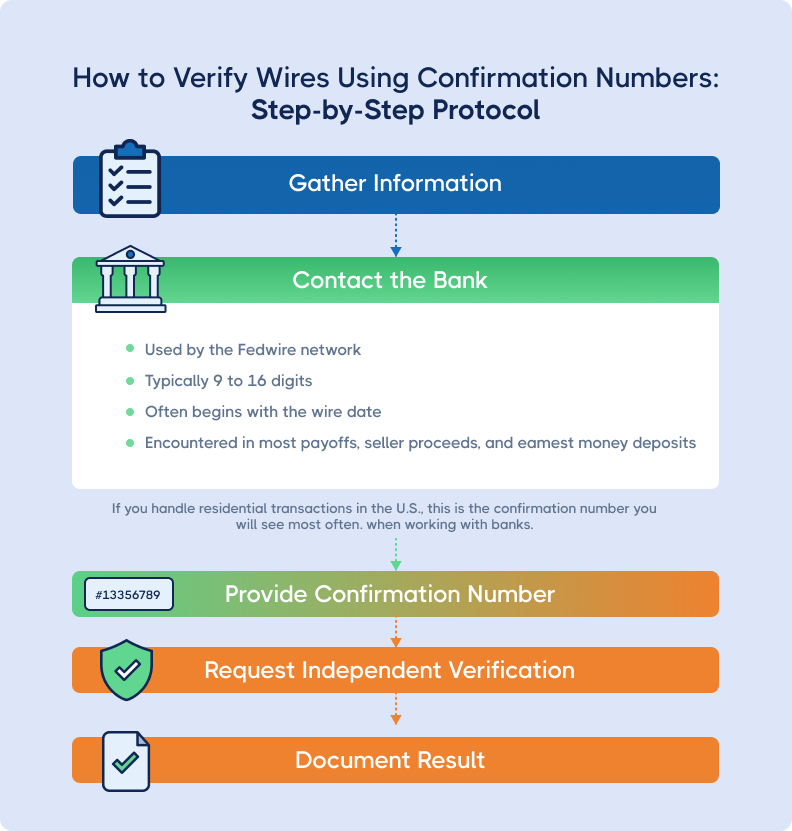

How to verify wires using confirmation numbers: Step-by-step protocol

Once you have a wire transfer confirmation number, verification should follow a clear and repeatable process. A consistent protocol helps protect you legally, operationally, and during audits or disputes.

Before initiating a wire, many firms also use secure wire verification software to validate instructions upfront. Verifying account details before funds leave your account makes confirmation number verification a final check rather than your only safeguard.

Step 1: Use verified contact information

Always use phone numbers from an official bank website or printed bank statements. Do not rely on contact information found in emails or client-provided documents. When you call, ask specifically for the bank’s wire department or treasury services team. General customer service representatives might not have access to wire details and may not be able to help.

Step 2: Provide details and request confirmation

Begin the conversation by providing the confirmation number. Then ask the bank to confirm the beneficiary name, the last four digits of the account number, the exact amount, and the current status of the wire. This approach ensures the bank is confirming information you already have, rather than supplying new details that could introduce errors.

Step 3: Document everything

During the call, document the bank representative’s full name and any employee ID or reference number they provide. Record what was confirmed, including the wire status, beneficiary, and amount. If a case or trace number is assigned, include that as well. Be sure to note the date and time of the conversation.

Step 4: Record in your file immediately

Record the verification in your file as soon as the call ends, while the details are still fresh. Use a consistent format that includes the verification date and time, bank name, representative name, confirmation number, wire status, verified amount, and account ending digits. Consistency makes future reviews and audits much easier.

Verifying incoming funds (earnest money, buyer cash-to-close)

For incoming wires, collect the confirmation number from the sender, then contact your own bank rather than the sender’s bank. Independently verify that the funds have arrived in your escrow account. Do not disburse funds until this verification is complete, and document the confirmation before closing.

Verifying outgoing disbursements (payoffs, seller proceeds)

For outgoing wires, request the confirmation number immediately after sending. Sharing it with recipients along with a disbursement statement helps reduce follow-up questions. If a recipient reports non-receipt, use the confirmation number to trace the wire with both banks and confirm when it was sent.

Beyond day-to-day operations, these verification steps also support compliance, audits, and insurance requirements.

Wire transfer confirmation compliance and documentation

Wire transfer confirmation numbers play an important role in compliance, audits, insurance claims, and legal disputes. Having clear documentation practices in place helps protect your firm long after a transaction is complete.

Professional and regulatory standards

Industry standards expect clear wire documentation. ALTA Best Practice #4 specifically addresses written wire procedures and emphasizes the importance of maintaining records that demonstrate how funds were handled. Confirmation numbers are a key part of that documentation and are often required to meet certification standards.

Attorneys should also be aware that state bar trust account rules typically require detailed records of funds received and disbursed. In some states, confirmation details must be recorded directly in trust ledgers.

E&O insurance policies may also require proof that verification procedures were followed, and confirmation numbers help demonstrate compliance if a claim arises.

Documentation retention requirements

Each transaction file should include wire authorization forms, confirmation numbers for sent and received wires, verification notes, bank receipts or screenshots, and any related correspondence.

Retention periods are set by state requirements and often range from five to seven years. Attorneys with claims-made policies may want to retain records longer. Digital storage makes long-term retention more manageable.

Training and internal standardization

Consistent documentation depends on consistent training. Firms should maintain written wire procedures and train all staff who handle wires. Periodic refreshers and occasional file audits help identify gaps and ensure procedures stay aligned as technology and fraud risks evolve.

Taken together, confirmation numbers, verification steps, and documentation practices form a complete approach to wire safety.

Protecting your real estate transactions with wire confirmation numbers

Wire transfer confirmation numbers are among the most reliable tools for tracking funds during a real estate transaction, but they only provide protection when they are consistently located, verified, and documented as part of a clear process.

While every wire receives a confirmation number, no confirmation number can replace independent verification or validate that funds were sent to the correct account.

Set aside fifteen minutes this week to review your current wire procedures. Look for documentation gaps, update written protocols, and make sure your team knows where to find confirmation numbers in your banking system. Wire fraud tactics continue to evolve, and staying protected requires ongoing attention.

Stay alert to wire fraud. Subscribe to our newsletter for monthly updates on fraud alerts, security tips, and easy steps you can take right away.

FAQ

Can someone fake a wire transfer confirmation number?

Yes, it is possible, and it happens more often than many people realize. Fraudsters regularly create fake screenshots, forged receipts, and realistic- looking documents that include confirmation numbers. Because of this risk, confirmation numbers should never be accepted on their own. Always verify wires independently by contacting the bank using a phone number from the bank’s official website.

What should I do if a confirmation number can't be found in the bank's system?

Start with basic troubleshooting. Double-check for typos, confirm which type of confirmation number you are searching for, such as IMAD or OMAD, and make sure the correct date range is selected. Providing additional details like the amount or beneficiary name can also help. If the number still cannot be found, request a formal investigation. A confirmation number that does not exist anywhere can be a sign that the wire was never sent.

Do I need a confirmation number if the seller refuses identity or wire verification?

If a seller refuses identity or wire verification, you should not wire proceeds. In those situations, offering check pickup or mailing a check is a safer alternative. A confirmation number only proves that a wire was sent. It does not remove liability for failing to verify the recipient first.

Does my bank charge fees for providing wire confirmation numbers?

Banks do not charge separate fees for confirmation numbers, since they are generated automatically. Fees apply to the wire transfer itself. Some title-friendly banks (BankUnited, Capital Bank) offer reduced or zero wire fees, which may be worth reviewing if you handle high volumes.

Can I use confirmation numbers alone to satisfy E&O insurance verification requirements?

Usually not. Confirmation numbers are typically one part of documentation, not a complete verification requirement. Check your specific policy or speak with your insurance broker to confirm what is required.

Content Marketer

Michelle has spent her career in B2B SaaS startups leading content marketing, strategy, and social media efforts that help teams grow and audiences stay informed. At CertifID, she applies that expertise to help title and real estate professionals understand fraud risks and stay ahead of emerging threats.

You’ve just sent a $275,000 mortgage payoff wire. Three hours later, the lender calls asking where the money is.

There’s no confirmation email. No tracking number in your inbox. No easy way to prove where the funds are or even confirm they’re moving. Your client is anxious. Your team is scrambling. And you’re stuck in the uncomfortable gap between “we sent it” and “we can prove it.”

For many title professionals, this moment is familiar. After clicking send, wires can feel like they disappear into a black hole. Clients ask, “Where’s my money?” and too often, the honest answer is that you’re still waiting for clarity.

That’s where wire transfer confirmation numbers come in. Before getting into how to use them, it helps to understand exactly what a confirmation number is and what role it plays in a wire transfer.

Every wire transfer automatically receives a confirmation number. Firms that effectively prevent fraud and reduce risk understand how to find these numbers, verify them correctly, and document them consistently.

This guide explains what wire confirmation numbers are, the different types used in practice, where to find them, how to verify wires step-by-step, and how confirmation numbers help manage risk without fully protecting against fraud on their own.

What is a wire transfer confirmation number?

A wire transfer confirmation number is a unique identifier assigned by a bank or payment network when a wire transfer is sent or received. It works a lot like a tracking number for money and gives you a way to follow a wire after it has been initiated.

Every legitimate wire transfer receives a confirmation number automatically. This is standard banking practice, whether the wire is domestic or international, incoming or outgoing.

Confirmation numbers are valuable because they:

- Prove a wire was initiated and entered into the banking system

- Allow banks to trace a wire’s status

- Create an official audit trail for compliance, disputes, and investigations

What a confirmation number is not

To avoid confusion, it helps to understand what confirmation numbers do not represent:

- It is not a routing number. Routing numbers identify banks, not individual wire transfers.

- It is not an account number. Account numbers identify where funds are intended to go.

- It is not an internal file number or escrow reference. Confirmation numbers come from the banking network, not from your closing or accounting software.

Why one wire can have multiple confirmation numbers

Wire transfers move through payment networks such as Fedwire, CHIPS, or SWIFT. Because of that, a single wire transfer can generate more than one reference number along the way. You may see:

- A confirmation number created by the sending bank

- A confirmation number created by the receiving bank

- A reference generated by the payment network itself

Understanding which confirmation number you are looking at and which one you need for verification is an important part of tracking and confirming wire transfers accurately.

.png)

Types of wire transfer confirmation numbers

Not all confirmation numbers look the same. Different digital payment networks use different formats and naming conventions. Knowing which type you are dealing with makes it easier to verify wires correctly and avoid unnecessary delays.

Federal reference number (Fedwire)

This is the most common confirmation number for domestic U.S. wires.

- Used by the Fedwire network

- Typically 9 to 16 digits

- Often begins with the wire date

- Encountered in most payoffs, seller proceeds, and earnest money deposits

If you handle residential transactions in the U.S., this is the confirmation number you will see most often.

IMAD and OMAD numbers

These numbers track the same Fedwire transfer from opposite ends of the transaction.

- IMAD (Input Message Accountability Data): created by the sending bank

- OMAD (Output Message Accountability Data): created by the receiving bank

- Typically 8-character alphanumeric codes

IMAD numbers are used to verify outgoing wires, while OMAD numbers are used to confirm incoming funds. Knowing which one to request can save a lot of time when working with banks.

CHIPS sequence number (SSN)

This confirmation number is used by the Clearing House Interbank Payments System, also known as CHIPS.

- Numeric format

- More common in large commercial transactions

- Seen less frequently in residential closings

SWIFT UETR (Unique End-to-End Transaction Reference)

This reference is used for international wire transfers on the SWIFT network.

- 36-character alphanumeric code

- Follows ISO 20022 standards

- Common with foreign buyers, international sellers, or offshore entities

MT103 reference

The MT103 is a SWIFT message format used for international payments.

- Contains both confirmation data and payment instructions

- Often used as proof of transfer for international wires

Once you know which confirmation numbers you may encounter, the next step is knowing where to find them when you actually need them.

Where to find wire transfer confirmation numbers

Banks do not always send wire transfer confirmation numbers automatically. Waiting for one to arrive on its own can create unnecessary stress, especially when a transaction is time-sensitive. The safest approach is to take an active role in locating the confirmation number as soon as a wire is sent.

Bank receipts and transaction records

Many banks include the confirmation number on a wire receipt or transaction record, whether it is provided on paper or as a PDF.

The labeling is not always consistent, so the number may appear as a reference number, trace number, Fed reference, or transaction ID. Becoming familiar with your bank’s terminology makes it easier to find quickly.

Online banking portals

Online banking portals tend to display confirmation numbers under sections like wire activity or transaction history. In some systems, the number appears immediately after the wire is submitted. In others, it shows up once the transaction processes. Taking time to learn where your bank displays this information can save time later.

Email notifications

Some banks send confirmation numbers by email, while others do not or require notifications to be enabled. If no email arrives shortly after sending a wire, do not assume one is coming. Follow up directly with your bank instead.

Direct request from your bank

Calling your bank’s wire department or treasury services team is often the fastest way to get a confirmation number. With the wire date, amount, and beneficiary name, bank representatives can usually provide it right away and confirm the wire’s status.

Finding the confirmation number is an important step, but understanding what it actually confirms is just as important.

What wire transfer confirmation numbers prove (and what they don't)

Wire transfer confirmation numbers are important, but they are easy to misunderstand. In real estate transactions, they can create confusion about what has actually been confirmed and what still needs to be verified.

When used the right way, confirmation numbers add clarity and documentation. When relied on too heavily, they can create a false sense of comfort.

What wire transfer status confirmation numbers DO prove

A confirmation number proves that a wire transfer exists within the payment network and that it was successfully initiated. It creates an official record showing that the wire entered the banking system and allows banks to track its status, whether the transfer is pending, completed, or returned.

Confirmation numbers make it possible for banks to investigate issues and trace funds if something goes wrong. From a compliance standpoint, they provide documentation that supports internal records, audits, and insurance requirements. Without a confirmation number, banks have a very limited ability to help locate or recover funds.

What confirmation numbers DO NOT prove

At the same time, confirmation numbers have clear limitations. They do not confirm that funds were sent to the correct account. They do not guarantee that funds are immediately available. They also do not validate the identity of the recipient.

This matters because fraudsters frequently create fake wire receipts, screenshots, and PDFs that include realistic-looking confirmation numbers. In many business email compromise cases, forged confirmations are used to create urgency and push teams to move forward too quickly.

For that reason, confirmation numbers should be treated as one data point, not full proof that a transaction is safe or complete.

The verification gap in real estate closings

This misunderstanding shows up during closings. A buyer may send a screenshot showing a confirmation number for earnest money and claim the wire is complete. At that point, it can be tempting to move forward, especially when everyone is eager to close.

However, that documentation alone is not enough. The wire could still be pending, sent to the wrong account, or entirely fabricated. The safest step is independent verification with your own bank to confirm the funds have actually arrived in your escrow account before proceeding.

This is where having a clear, repeatable verification process makes a difference.

.png)

How to verify wires using confirmation numbers: Step-by-step protocol

Once you have a wire transfer confirmation number, verification should follow a clear and repeatable process. A consistent protocol helps protect you legally, operationally, and during audits or disputes.

Before initiating a wire, many firms also use secure wire verification software to validate instructions upfront. Verifying account details before funds leave your account makes confirmation number verification a final check rather than your only safeguard.

Step 1: Use verified contact information

Always use phone numbers from an official bank website or printed bank statements. Do not rely on contact information found in emails or client-provided documents. When you call, ask specifically for the bank’s wire department or treasury services team. General customer service representatives might not have access to wire details and may not be able to help.

Step 2: Provide details and request confirmation

Begin the conversation by providing the confirmation number. Then ask the bank to confirm the beneficiary name, the last four digits of the account number, the exact amount, and the current status of the wire. This approach ensures the bank is confirming information you already have, rather than supplying new details that could introduce errors.

Step 3: Document everything

During the call, document the bank representative’s full name and any employee ID or reference number they provide. Record what was confirmed, including the wire status, beneficiary, and amount. If a case or trace number is assigned, include that as well. Be sure to note the date and time of the conversation.

Step 4: Record in your file immediately

Record the verification in your file as soon as the call ends, while the details are still fresh. Use a consistent format that includes the verification date and time, bank name, representative name, confirmation number, wire status, verified amount, and account ending digits. Consistency makes future reviews and audits much easier.

Verifying incoming funds (earnest money, buyer cash-to-close)

For incoming wires, collect the confirmation number from the sender, then contact your own bank rather than the sender’s bank. Independently verify that the funds have arrived in your escrow account. Do not disburse funds until this verification is complete, and document the confirmation before closing.

Verifying outgoing disbursements (payoffs, seller proceeds)

For outgoing wires, request the confirmation number immediately after sending. Sharing it with recipients along with a disbursement statement helps reduce follow-up questions. If a recipient reports non-receipt, use the confirmation number to trace the wire with both banks and confirm when it was sent.

Beyond day-to-day operations, these verification steps also support compliance, audits, and insurance requirements.

Wire transfer confirmation compliance and documentation

Wire transfer confirmation numbers play an important role in compliance, audits, insurance claims, and legal disputes. Having clear documentation practices in place helps protect your firm long after a transaction is complete.

Professional and regulatory standards

Industry standards expect clear wire documentation. ALTA Best Practice #4 specifically addresses written wire procedures and emphasizes the importance of maintaining records that demonstrate how funds were handled. Confirmation numbers are a key part of that documentation and are often required to meet certification standards.

Attorneys should also be aware that state bar trust account rules typically require detailed records of funds received and disbursed. In some states, confirmation details must be recorded directly in trust ledgers.

E&O insurance policies may also require proof that verification procedures were followed, and confirmation numbers help demonstrate compliance if a claim arises.

Documentation retention requirements

Each transaction file should include wire authorization forms, confirmation numbers for sent and received wires, verification notes, bank receipts or screenshots, and any related correspondence.

Retention periods are set by state requirements and often range from five to seven years. Attorneys with claims-made policies may want to retain records longer. Digital storage makes long-term retention more manageable.

Training and internal standardization

Consistent documentation depends on consistent training. Firms should maintain written wire procedures and train all staff who handle wires. Periodic refreshers and occasional file audits help identify gaps and ensure procedures stay aligned as technology and fraud risks evolve.

Taken together, confirmation numbers, verification steps, and documentation practices form a complete approach to wire safety.

Protecting your real estate transactions with wire confirmation numbers

Wire transfer confirmation numbers are among the most reliable tools for tracking funds during a real estate transaction, but they only provide protection when they are consistently located, verified, and documented as part of a clear process.

While every wire receives a confirmation number, no confirmation number can replace independent verification or validate that funds were sent to the correct account.

Set aside fifteen minutes this week to review your current wire procedures. Look for documentation gaps, update written protocols, and make sure your team knows where to find confirmation numbers in your banking system. Wire fraud tactics continue to evolve, and staying protected requires ongoing attention.

Stay alert to wire fraud. Subscribe to our newsletter for monthly updates on fraud alerts, security tips, and easy steps you can take right away.

Content Marketer

Michelle has spent her career in B2B SaaS startups leading content marketing, strategy, and social media efforts that help teams grow and audiences stay informed. At CertifID, she applies that expertise to help title and real estate professionals understand fraud risks and stay ahead of emerging threats.

Sign up for The Wire to join the conversation.

.png)