Impersonation scams: The ultimate guide to recognition, prevention, and protection

Real estate fraud is evolving fast, and impersonation scams are leading the charge. Learn how they work, who they target, and how you can stay one step ahead.

Arpitha Gadag

9 minutes

Fraud Prevention

Apr 11, 2024

Aug 5, 2025

Impersonation scams cost Americans around $3 billion each year, and real estate professionals are prime targets. With high-dollar transactions, sensitive data bouncing between inboxes, and multiple parties involved in every deal, it’s no wonder fraudsters are getting creative.

From fake identities and spoofed emails to deepfake videos and AI-generated phone calls, impersonation scams are getting harder to spot and more expensive to recover from.

Here’s how they work, what red flags to watch for, and how to protect your clients and business.

What are impersonation scams?

Impersonation scams happen when someone pretends to be a person or organization you trust (your bank, your attorney, even your coworker) to trick you into sending money or sensitive information.

At the heart of most impersonation scams are three key tactics:

- Urgency: “You need to act now or the deal falls through.”

- High stakes: “Legal action will be taken if you don’t respond.”

- Emotional pressure: “Don’t risk losing your home or your money—send the payment now.”

Impersonation scams are difficult to catch because they target individuals rather than just systems.

Fraudsters send thousands of emails or texts needing only one person to respond. And thanks to AI, scammers can create fake documents, emails, and voice clones that sound nearly identical to someone you trust.

Want to hear how this works in action? Check out this quick video on AI audio spoofing and how close an AI voice is to an actual person’s voice.

Bottom line: these scams are built to catch people off guard.

In real estate, the most popular scam is seller impersonation fraud. It happens when a fraudster poses as the rightful property owner to trick a title agent or an attorney into transferring proceeds to them. We’ll talk more in-depth about this type of scam in a moment.

Inside a scam: How impersonation fraud works in 4 steps

Impersonation scams all follow the same basic formula: a fraudster pretends to be someone you trust, makes a request that feels urgent, and uses that moment of pressure to get what they want.

The tactics vary, but the goal is always the same: trick you into acting before you can verify.

Let’s take a look at one of the examples.

1. The research phase: "They know more about your deal than you think”

Sarah just listed her $450,000 home online. Within hours, fraudsters have already found her property listing, researched her name in public records, and discovered she's relocating for work.

They know her real estate agent's name, the listing details, and even found her social media posts about the move. What feels like private information is actually scattered across the internet, giving criminals everything they need to sound legitimate.

2. The infiltration: "Your trusted email becomes their weapon"

Mike, a busy real estate agent, clicks on what looks like a routine MLS update email. Unknown to him, this email contained malware that gave fraudsters access to his inbox.

For weeks, they silently monitor his conversations with clients, learning about upcoming closings, bank details, and communication patterns. They're essentially sitting in on every email conversation, waiting for the perfect moment to strike.

3. The impersonation: "The email that changes everything"

Three days before closing, the seller receives an email that appears to be from their trusted agent Mike: "Great news! We secured a better rate with a different title company.

Here are the updated wire instructions for your proceeds." The email address looks right, the tone matches, and the timing seems logical. The seller has no reason to doubt it's really from Mike.

4. The heist: "By the time you realize, it's too late"

The seller wires their $180,000 proceeds to what they believe is the legitimate account. Within minutes, the money begins moving through a network of accounts across different banks and countries.

When the real closing happens and everyone realizes no proceeds arrived, the trail has already gone cold. The seller's life savings—gone in an instant.

12 common types of impersonation scams

Here are some of the most common impersonation scam examples

Let’s dive into two examples: IRS scam and, later on, seller impersonation scam related to the real estate industry.

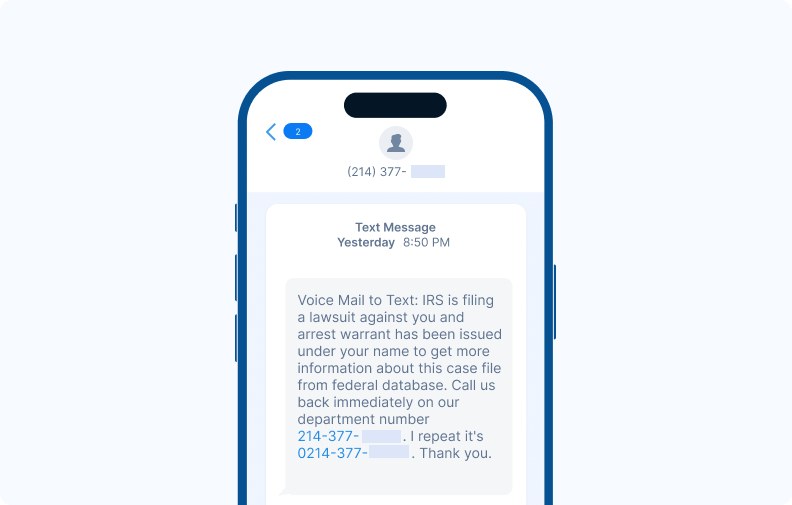

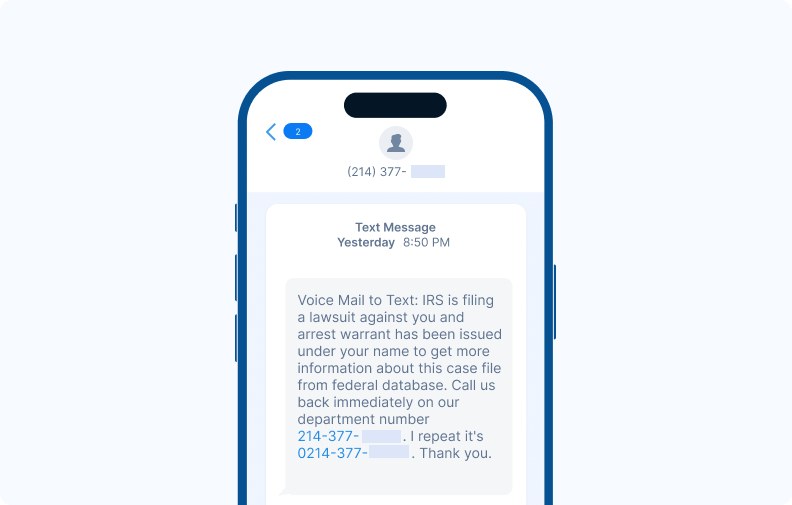

IRS impersonation scam example

Say you get a call from someone claiming to be with the IRS. They say you owe a large amount in back taxes and threaten to send law enforcement if you don’t call back immediately. They promise to help you avoid legal action if you pay today.

This scam uses urgency, fear of consequences, and pressure to elicit a response.

While you might think you wouldn't fall for it, someone unsure about their tax status might panic and call back, leading to serious consequences.

Impersonation scams exploit specific vulnerabilities, making even extreme scenarios feel real when someone is caught off guard.

Seller impersonation scam in real estate

Seller impersonation fraud is a growing threat, especially with vacant land, out-of-state owners, or LLC-held properties, where verifying ownership is tougher.

These scams often begin with fraudsters searching public records to identify vulnerable parties, making them prime targets for impersonation.

As the image below shows, scammers follow a predictable pattern. They:

- Pose as the rightful seller

- Contact real estate agents to list the property

- Price it below market value

- Push for quick, cash-only transactions

- Use remote notarization, using fake IDs

By the time the fraud is discovered, the fraudsters not only have the funds in their accounts but have often already converted them into cryptocurrencies, making the money nearly impossible to recover.

Title professionals like Rachel Petrach, Chief Closing and Compliance Officer at Knight Barry Title Group, first saw these scams in Florida before they spread across states. “We used to take licenses at face value,” she said. “That’s exactly what scammers count on.”

To fight back, Knight Barry uses multi-layered checks, such as mailing packages to tax addresses, geo-tracking emails, and verifying accounts before fund transfers. They aim to identify potential fraud early on. Although seller impersonation remains a challenge, informed title professionals can work to stay ahead.

Warning signs of impersonation scams

Impersonation scams are rarely loud and obvious. They’re built to blend in, and by the time someone raises their hand to ask, “Wait, is this real?” it might be too late.

From fake buyers and sellers to spoofed lenders, these scams are broad, but the red flags are often the same.

Here’s what you should watch for.

Universal warning signs

- Unexpected urgent requests for money or sensitive information

- Unfamiliar contact details or minor variations in email addresses or websites

- Pressure to act immediately without time for standard review or verification

- Requests for secrecy, like “Don’t loop anyone else in yet.”

- Poor grammar or unprofessional communication that doesn’t match typical industry tone

- Refusal to meet in person or provide additional ID or documentation

- Suspicious links or attachments that prompt you to click or download something

Most impersonation scams rely on urgency, fear, and personal details. Here’s how those red flags show up during a real estate closing.

Real estate-specific red flags

Impersonation scams hit real estate hardest during high-risk moments. If you spot any of these red flags, it’s best to pause and verify before moving forward.

Last-minute payoff changes

If a lender sends new wire instructions right before closing, be cautious. Legitimate lenders don’t make last-minute changes. Always confirm using a verified contact number.

Seller unavailability

If a seller avoids live communication, it's a significant red flag. Genuine sellers should be willing to verify transaction details through multiple methods.

Unusual payment requests

Requests for earnest money through cryptocurrency, gift cards, or overseas wire transfers are not standard practice, ever. Legitimate transactions use regulated, traceable payment methods.

Documentation inconsistencies

Does the ID name match the signature? Does the tax bill address match the driver's license? The smallest discrepancies indicate fraud, so always ask questions if something seems off.

Pressure tactics

Fraudsters rely on urgency to get deals done before anyone has a second thought or time to ask questions. Phrases like “The buyer will walk if we don’t close today” are designed to create panic.

If someone pushes to bypass standard procedures, that’s often a sign the deal isn’t real. That pattern isn’t limited to real estate. It shows up across every type of impersonation scam.

Impact of impersonation scams

Impersonation scams are costly and disruptive. Whether it’s a buyer wiring funds to the wrong account or a title company unknowingly closing with a fake seller, the fallout is serious. Here’s what’s at stake.

Financial consequences

Individual losses

In 2023, real estate wire fraud topped $446M. Buyers can lose their entire down payment in minutes. For title companies and law firms, the fallout includes lost trust, financial liability, legal disputes, and E&O claims. Even close calls waste time and resources.

Across the industry, rising fraud volume has forced new verification standards and pushed more risk onto professionals, changing how real estate deals get done.

Professional and personal damage

Scams go beyond stealing funds. They damage reputations. One incident can lead to lost referrals, bad reviews, and long-term credibility hits, even when protocols were followed.

For individuals, the fallout is personal. Escrow officers can lose their jobs over missed red flags. Attorneys may face license reviews or audits. Rising fraud means more scrutiny and stress.

And behind every case is a person. Many professionals describe sleepless nights, second-guessing, and a lasting sense of “what if.”

Long-term effects

When fraud makes headlines, buyer confidence drops, especially among first-time buyers. That fear can ripple through the market, slowing deals and increasing buyer anxiety.

To stay safe, real estate teams are investing more in security: identity checks, bank account verification, staff training, all necessary but time-consuming and costly.

Insurance providers are responding by raising premiums and reducing wire fraud coverage. That means more risk lands on the professionals.

Impersonation scams do more than steal money, they derail deals, damage reputations, and exhaust resources. But early awareness can stop them in their tracks and make the difference between a closed deal and a six-figure loss.

Prevention and protection tips against impersonation fraud

The best defense against impersonation scams is a proactive one. As fraudsters evolve, so must tools and tactics. Here’s how to strengthen your frontline to protect your team, clients, and reputation.

Stay informed and educated

Stay informed. Subscribe to The Wire for the latest scam alerts and fraud prevention tips.

Train regularly. Keep your team up to date on the latest red flags, make it a habit, not a one-time thing.

Share what you see. Reporting suspicious activity helps protect the entire industry.

Implement strong authentication

Layered security makes it harder for fraudsters to break through, and small steps add up.

- Use multi-factor authentication (MFA) on all business accounts, especially email, wire platforms, and internal systems

- Use secure software solutions to verify wire instructions instead of relying on callbacks or phone numbers found in emails

- Verify documents with ID scanning and cross-referencing for inconsistencies

- Use digital signatures with encryption with audit trails for a secure, traceable record

Real estate-specific protections

Big transactions and tight timelines increase the risk of impersonation scams. That’s why your security practices need to be just as tailored as your workflow. Here is what every title company, attorney, and real estate team should have in place.

Payoff verification process

Don’t rely on callbacks alone. Use secure platforms to verify wire instructions and keep a clear record.

Seller identity confirmation

A single phone call isn’t enough. Cross-check documents with public records, use ID verification tools, and contact sellers through multiple, verified channels.

Wire instruction protocols

Never accept wire changes via email alone. Always confirm in person, by phone (using a known number), or through a secure platform.

Title production software integration

Use title production systems with secure document sharing, activity logs, and built-in checks to catch red flags before they cause damage.

Organizational safeguards

Protecting your business from impersonation scams isn’t just about spotting red flags in the moment. Build in layers that make fraud harder to pull off.

Here are a few internal practices that strengthen your defenses at the organizational level.

Segregation of duties

No single person should be responsible for verifying wire instructions and disbursing funds. Creating checkpoints (even on small teams) makes it harder for fraud to slip through.

Monitoring accounts daily

Regular reconciliation helps catch unauthorized activity early, when recovery is still possible.

Secure communication channels

Never send sensitive information over unencrypted email. Use secure portals for sharing wiring instructions, identity documents, and other private details.

Insurance coverage

Keep cyber liability and errors & omissions (E&O) insurance current, and know exactly what policies are covered in case of impersonation and wire fraud.

“It’s not enough to verify a transaction. We need to verify that the people involved are who they say they are.” Tyler Adams, CEO and Co-founder of CertifID

What to do if you're targeted or victimized

If you’ve been targeted or fallen victim to an impersonation scam, you’re not alone. Quick action can make the difference between recovery and loss.

The steps you take in the first few hours can make all the difference in recovery. Here’s what to do.

Immediate steps (0–2 hours)

Stop communication immediately

Once you sense something’s off (a strange request, mismatched info, a new sense of urgency) cut off all contact with the suspected fraudster. Don’t reply or click further.

Secure your systems

Change passwords on all critical accounts, starting with email, banking, and file-sharing platforms. Turn on multi-factor authentication (MFA) if it’s not already in place.

Contact your bank right away

If funds were transferred, call your bank’s fraud team to request an urgent wire recall and freeze the recipient account if possible.

Document everything

Keep a log of times, actions, and conversations. Save screenshots of all communications for law enforcement and insurance purposes.

Report the incident (2–4 hours)

File a report with the FBI IC3

Go to ic3.gov and submit a detailed complaint, including the amount lost, timing, suspicious communications, and recovery actions. Save your IC3 complaint number.

Call your local law enforcement

Reporting the fraud locally to create a record and support investigations. If possible, visit your nearest FBI field office with your IC3 number.

Notify internal teams

In real estate or law, alert your compliance team or manager right away to quickly contain the issue.

Recovery and moving forward (same day–next few days)

Talk to legal counsel

Whether funds were lost or fraud was attempted, consult an attorney with cybercrime experience. They can walk you through potential liability, insurance coverage, and recovery options.

Communicate transparently with clients

If a transaction was impacted, loop in the affected parties about the situation and your response. Honesty helps preserve trust.

Audit and improve internal processes

Figure out how the fraud occurred. Was the email compromised? Missed red flag? Use this opportunity to review and enhance your wire verification protocols.

Support your team

Fraud can take an emotional toll. If a team member made a mistake, focus on learning, not blaming. A safe culture speeds up response and recovery.

Recovering from impersonation scams is difficult, but it reinforces the importance of prevention. Staying informed and proactive makes all the difference.

Impersonation scams: Vigilance is your best defense

Impersonation scams aren’t going away. Fraudsters are getting smarter, more patient, and harder to detect. In fast-moving real estate deals, that makes the threat even more serious.

Prevention beats recovery every time. Remember to take the extra time to verify identities and double-check instructions. Use secure tools like ID verification, MFA, and wire protection software, coupled with your team’s attention to detail.

In a business built on trust, your attention to detail and commitment to staying informed is the best way to protect your clients and your reputation.

FAQ

Director of Fraud & Risk Products

Arpitha is a seasoned product leader with nearly a decade of experience in fraud prevention and digital identity verification. She has a proven track record of scaling products from 0 to 1 across startups and Fortune 500 companies alike. Driven by a deep commitment to access and equity, Arpitha is passionate about building inclusive digital identity experiences that empower individuals to engage confidently with the products they love, while stopping fraudsters in their tracks.

Impersonation scams cost Americans around $3 billion each year, and real estate professionals are prime targets. With high-dollar transactions, sensitive data bouncing between inboxes, and multiple parties involved in every deal, it’s no wonder fraudsters are getting creative.

From fake identities and spoofed emails to deepfake videos and AI-generated phone calls, impersonation scams are getting harder to spot and more expensive to recover from.

Here’s how they work, what red flags to watch for, and how to protect your clients and business.

What are impersonation scams?

Impersonation scams happen when someone pretends to be a person or organization you trust (your bank, your attorney, even your coworker) to trick you into sending money or sensitive information.

At the heart of most impersonation scams are three key tactics:

- Urgency: “You need to act now or the deal falls through.”

- High stakes: “Legal action will be taken if you don’t respond.”

- Emotional pressure: “Don’t risk losing your home or your money—send the payment now.”

Impersonation scams are difficult to catch because they target individuals rather than just systems.

Fraudsters send thousands of emails or texts needing only one person to respond. And thanks to AI, scammers can create fake documents, emails, and voice clones that sound nearly identical to someone you trust.

Want to hear how this works in action? Check out this quick video on AI audio spoofing and how close an AI voice is to an actual person’s voice.

Bottom line: these scams are built to catch people off guard.

In real estate, the most popular scam is seller impersonation fraud. It happens when a fraudster poses as the rightful property owner to trick a title agent or an attorney into transferring proceeds to them. We’ll talk more in-depth about this type of scam in a moment.

Inside a scam: How impersonation fraud works in 4 steps

Impersonation scams all follow the same basic formula: a fraudster pretends to be someone you trust, makes a request that feels urgent, and uses that moment of pressure to get what they want.

The tactics vary, but the goal is always the same: trick you into acting before you can verify.

Let’s take a look at one of the examples.

1. The research phase: "They know more about your deal than you think”

Sarah just listed her $450,000 home online. Within hours, fraudsters have already found her property listing, researched her name in public records, and discovered she's relocating for work.

They know her real estate agent's name, the listing details, and even found her social media posts about the move. What feels like private information is actually scattered across the internet, giving criminals everything they need to sound legitimate.

2. The infiltration: "Your trusted email becomes their weapon"

Mike, a busy real estate agent, clicks on what looks like a routine MLS update email. Unknown to him, this email contained malware that gave fraudsters access to his inbox.

For weeks, they silently monitor his conversations with clients, learning about upcoming closings, bank details, and communication patterns. They're essentially sitting in on every email conversation, waiting for the perfect moment to strike.

3. The impersonation: "The email that changes everything"

Three days before closing, the seller receives an email that appears to be from their trusted agent Mike: "Great news! We secured a better rate with a different title company.

Here are the updated wire instructions for your proceeds." The email address looks right, the tone matches, and the timing seems logical. The seller has no reason to doubt it's really from Mike.

4. The heist: "By the time you realize, it's too late"

The seller wires their $180,000 proceeds to what they believe is the legitimate account. Within minutes, the money begins moving through a network of accounts across different banks and countries.

When the real closing happens and everyone realizes no proceeds arrived, the trail has already gone cold. The seller's life savings—gone in an instant.

12 common types of impersonation scams

Here are some of the most common impersonation scam examples

Let’s dive into two examples: IRS scam and, later on, seller impersonation scam related to the real estate industry.

IRS impersonation scam example

Say you get a call from someone claiming to be with the IRS. They say you owe a large amount in back taxes and threaten to send law enforcement if you don’t call back immediately. They promise to help you avoid legal action if you pay today.

This scam uses urgency, fear of consequences, and pressure to elicit a response.

While you might think you wouldn't fall for it, someone unsure about their tax status might panic and call back, leading to serious consequences.

Impersonation scams exploit specific vulnerabilities, making even extreme scenarios feel real when someone is caught off guard.

Seller impersonation scam in real estate

Seller impersonation fraud is a growing threat, especially with vacant land, out-of-state owners, or LLC-held properties, where verifying ownership is tougher.

These scams often begin with fraudsters searching public records to identify vulnerable parties, making them prime targets for impersonation.

As the image below shows, scammers follow a predictable pattern. They:

- Pose as the rightful seller

- Contact real estate agents to list the property

- Price it below market value

- Push for quick, cash-only transactions

- Use remote notarization, using fake IDs

By the time the fraud is discovered, the fraudsters not only have the funds in their accounts but have often already converted them into cryptocurrencies, making the money nearly impossible to recover.

Title professionals like Rachel Petrach, Chief Closing and Compliance Officer at Knight Barry Title Group, first saw these scams in Florida before they spread across states. “We used to take licenses at face value,” she said. “That’s exactly what scammers count on.”

To fight back, Knight Barry uses multi-layered checks, such as mailing packages to tax addresses, geo-tracking emails, and verifying accounts before fund transfers. They aim to identify potential fraud early on. Although seller impersonation remains a challenge, informed title professionals can work to stay ahead.

Warning signs of impersonation scams

Impersonation scams are rarely loud and obvious. They’re built to blend in, and by the time someone raises their hand to ask, “Wait, is this real?” it might be too late.

From fake buyers and sellers to spoofed lenders, these scams are broad, but the red flags are often the same.

Here’s what you should watch for.

Universal warning signs

- Unexpected urgent requests for money or sensitive information

- Unfamiliar contact details or minor variations in email addresses or websites

- Pressure to act immediately without time for standard review or verification

- Requests for secrecy, like “Don’t loop anyone else in yet.”

- Poor grammar or unprofessional communication that doesn’t match typical industry tone

- Refusal to meet in person or provide additional ID or documentation

- Suspicious links or attachments that prompt you to click or download something

Most impersonation scams rely on urgency, fear, and personal details. Here’s how those red flags show up during a real estate closing.

Real estate-specific red flags

Impersonation scams hit real estate hardest during high-risk moments. If you spot any of these red flags, it’s best to pause and verify before moving forward.

Last-minute payoff changes

If a lender sends new wire instructions right before closing, be cautious. Legitimate lenders don’t make last-minute changes. Always confirm using a verified contact number.

Seller unavailability

If a seller avoids live communication, it's a significant red flag. Genuine sellers should be willing to verify transaction details through multiple methods.

Unusual payment requests

Requests for earnest money through cryptocurrency, gift cards, or overseas wire transfers are not standard practice, ever. Legitimate transactions use regulated, traceable payment methods.

Documentation inconsistencies

Does the ID name match the signature? Does the tax bill address match the driver's license? The smallest discrepancies indicate fraud, so always ask questions if something seems off.

Pressure tactics

Fraudsters rely on urgency to get deals done before anyone has a second thought or time to ask questions. Phrases like “The buyer will walk if we don’t close today” are designed to create panic.

If someone pushes to bypass standard procedures, that’s often a sign the deal isn’t real. That pattern isn’t limited to real estate. It shows up across every type of impersonation scam.

Impact of impersonation scams

Impersonation scams are costly and disruptive. Whether it’s a buyer wiring funds to the wrong account or a title company unknowingly closing with a fake seller, the fallout is serious. Here’s what’s at stake.

Financial consequences

Individual losses

In 2023, real estate wire fraud topped $446M. Buyers can lose their entire down payment in minutes. For title companies and law firms, the fallout includes lost trust, financial liability, legal disputes, and E&O claims. Even close calls waste time and resources.

Across the industry, rising fraud volume has forced new verification standards and pushed more risk onto professionals, changing how real estate deals get done.

Professional and personal damage

Scams go beyond stealing funds. They damage reputations. One incident can lead to lost referrals, bad reviews, and long-term credibility hits, even when protocols were followed.

For individuals, the fallout is personal. Escrow officers can lose their jobs over missed red flags. Attorneys may face license reviews or audits. Rising fraud means more scrutiny and stress.

And behind every case is a person. Many professionals describe sleepless nights, second-guessing, and a lasting sense of “what if.”

Long-term effects

When fraud makes headlines, buyer confidence drops, especially among first-time buyers. That fear can ripple through the market, slowing deals and increasing buyer anxiety.

To stay safe, real estate teams are investing more in security: identity checks, bank account verification, staff training, all necessary but time-consuming and costly.

Insurance providers are responding by raising premiums and reducing wire fraud coverage. That means more risk lands on the professionals.

Impersonation scams do more than steal money, they derail deals, damage reputations, and exhaust resources. But early awareness can stop them in their tracks and make the difference between a closed deal and a six-figure loss.

Prevention and protection tips against impersonation fraud

The best defense against impersonation scams is a proactive one. As fraudsters evolve, so must tools and tactics. Here’s how to strengthen your frontline to protect your team, clients, and reputation.

Stay informed and educated

Stay informed. Subscribe to The Wire for the latest scam alerts and fraud prevention tips.

Train regularly. Keep your team up to date on the latest red flags, make it a habit, not a one-time thing.

Share what you see. Reporting suspicious activity helps protect the entire industry.

Implement strong authentication

Layered security makes it harder for fraudsters to break through, and small steps add up.

- Use multi-factor authentication (MFA) on all business accounts, especially email, wire platforms, and internal systems

- Use secure software solutions to verify wire instructions instead of relying on callbacks or phone numbers found in emails

- Verify documents with ID scanning and cross-referencing for inconsistencies

- Use digital signatures with encryption with audit trails for a secure, traceable record

Real estate-specific protections

Big transactions and tight timelines increase the risk of impersonation scams. That’s why your security practices need to be just as tailored as your workflow. Here is what every title company, attorney, and real estate team should have in place.

Payoff verification process

Don’t rely on callbacks alone. Use secure platforms to verify wire instructions and keep a clear record.

Seller identity confirmation

A single phone call isn’t enough. Cross-check documents with public records, use ID verification tools, and contact sellers through multiple, verified channels.

Wire instruction protocols

Never accept wire changes via email alone. Always confirm in person, by phone (using a known number), or through a secure platform.

Title production software integration

Use title production systems with secure document sharing, activity logs, and built-in checks to catch red flags before they cause damage.

Organizational safeguards

Protecting your business from impersonation scams isn’t just about spotting red flags in the moment. Build in layers that make fraud harder to pull off.

Here are a few internal practices that strengthen your defenses at the organizational level.

Segregation of duties

No single person should be responsible for verifying wire instructions and disbursing funds. Creating checkpoints (even on small teams) makes it harder for fraud to slip through.

Monitoring accounts daily

Regular reconciliation helps catch unauthorized activity early, when recovery is still possible.

Secure communication channels

Never send sensitive information over unencrypted email. Use secure portals for sharing wiring instructions, identity documents, and other private details.

Insurance coverage

Keep cyber liability and errors & omissions (E&O) insurance current, and know exactly what policies are covered in case of impersonation and wire fraud.

“It’s not enough to verify a transaction. We need to verify that the people involved are who they say they are.” Tyler Adams, CEO and Co-founder of CertifID

What to do if you're targeted or victimized

If you’ve been targeted or fallen victim to an impersonation scam, you’re not alone. Quick action can make the difference between recovery and loss.

The steps you take in the first few hours can make all the difference in recovery. Here’s what to do.

Immediate steps (0–2 hours)

Stop communication immediately

Once you sense something’s off (a strange request, mismatched info, a new sense of urgency) cut off all contact with the suspected fraudster. Don’t reply or click further.

Secure your systems

Change passwords on all critical accounts, starting with email, banking, and file-sharing platforms. Turn on multi-factor authentication (MFA) if it’s not already in place.

Contact your bank right away

If funds were transferred, call your bank’s fraud team to request an urgent wire recall and freeze the recipient account if possible.

Document everything

Keep a log of times, actions, and conversations. Save screenshots of all communications for law enforcement and insurance purposes.

Report the incident (2–4 hours)

File a report with the FBI IC3

Go to ic3.gov and submit a detailed complaint, including the amount lost, timing, suspicious communications, and recovery actions. Save your IC3 complaint number.

Call your local law enforcement

Reporting the fraud locally to create a record and support investigations. If possible, visit your nearest FBI field office with your IC3 number.

Notify internal teams

In real estate or law, alert your compliance team or manager right away to quickly contain the issue.

Recovery and moving forward (same day–next few days)

Talk to legal counsel

Whether funds were lost or fraud was attempted, consult an attorney with cybercrime experience. They can walk you through potential liability, insurance coverage, and recovery options.

Communicate transparently with clients

If a transaction was impacted, loop in the affected parties about the situation and your response. Honesty helps preserve trust.

Audit and improve internal processes

Figure out how the fraud occurred. Was the email compromised? Missed red flag? Use this opportunity to review and enhance your wire verification protocols.

Support your team

Fraud can take an emotional toll. If a team member made a mistake, focus on learning, not blaming. A safe culture speeds up response and recovery.

Recovering from impersonation scams is difficult, but it reinforces the importance of prevention. Staying informed and proactive makes all the difference.

Impersonation scams: Vigilance is your best defense

Impersonation scams aren’t going away. Fraudsters are getting smarter, more patient, and harder to detect. In fast-moving real estate deals, that makes the threat even more serious.

Prevention beats recovery every time. Remember to take the extra time to verify identities and double-check instructions. Use secure tools like ID verification, MFA, and wire protection software, coupled with your team’s attention to detail.

In a business built on trust, your attention to detail and commitment to staying informed is the best way to protect your clients and your reputation.

Director of Fraud & Risk Products

Arpitha is a seasoned product leader with nearly a decade of experience in fraud prevention and digital identity verification. She has a proven track record of scaling products from 0 to 1 across startups and Fortune 500 companies alike. Driven by a deep commitment to access and equity, Arpitha is passionate about building inclusive digital identity experiences that empower individuals to engage confidently with the products they love, while stopping fraudsters in their tracks.

Sign up for The Wire to join the conversation.

.png)