How to build a strong partnership as a title agent with your underwriter

Your underwriter relationship determines whether you close on time or scramble. Here's how to build it right.

Peter Engleman

6 minutes

Education

Feb 18, 2026

Feb 18, 2026

You submit a curative issue at 3:45 PM on a Friday. The buyer's lender deadline is Monday morning. You need underwriting guidance now.

Some title professionals wait 5-7 days for basic title searches or O&E reports. Others describe underwriters who answer immediately and work until the problem's resolved.

This gap isn't random. It reflects the partnership you built before the crisis hit. Building a strong underwriter relationship before you need it ensures responsive support when deals get complicated.

Why the title agent-underwriter partnership matters

Your underwriter does more than issue policies. They handle title searches, clear liens, approve endorsements, guide you through curative matters, protect against claims, and support complex transactions.

They're your risk partners who determine whether you close on time or scramble to explain delays.

When the partnership is weak, you face:

- Last-minute exceptions that delay closings and frustrate all parties

- Unclear or delayed curative guidance that leaves you exposed and uncertain how to proceed

- Getting caught between underwriter compliance requirements and pressure from agents to close quickly

- The blame game when deals fall through—one title professional described being required to disclose pending condo assessments, only to have the listing agent blame them for "throwing the deal" even though they followed proper protocol

Strong partnerships change everything:

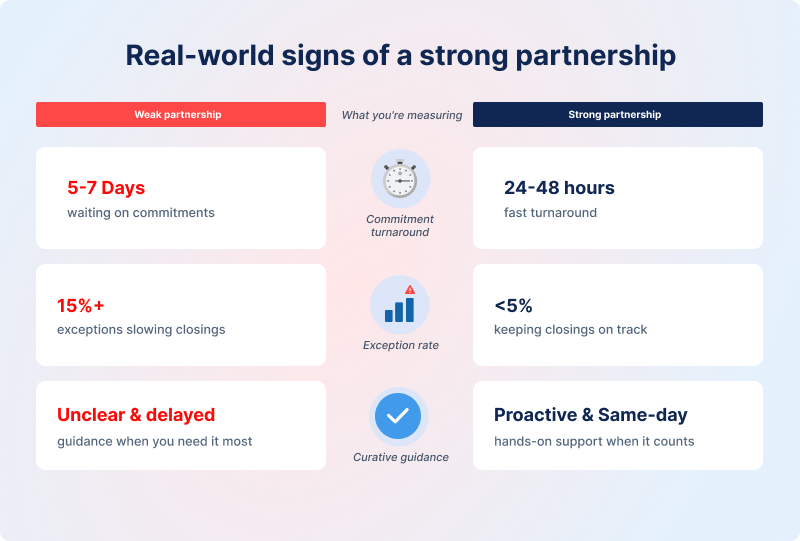

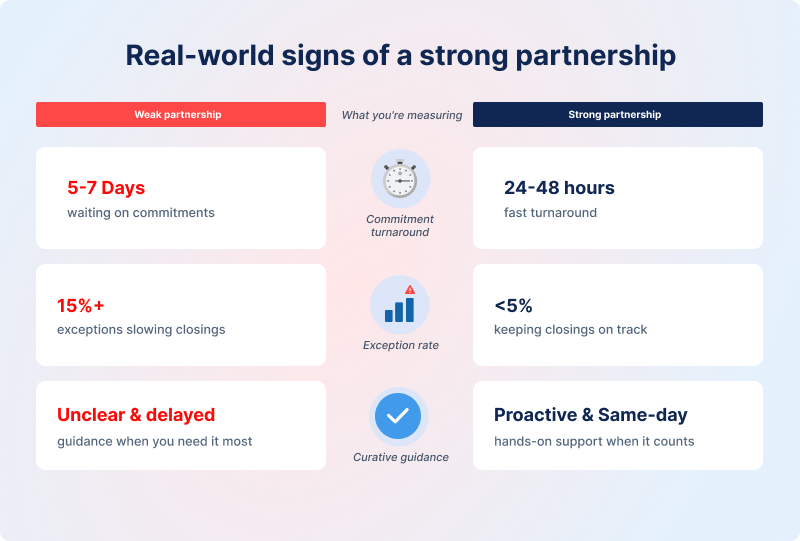

- Commitment turnaround in 24-48 hours instead of 5-7 days

- Direct lines to underwriters who already know your business and transaction patterns

- Proactive guidance on commercial deals or LLC purchases before problems surface

Beyond speed metrics, the real value is having a partner who understands your volume, your market, and your specific challenges. Someone who advocates for your urgent requests internally because they know you and trust your work.

Why response times vary across underwriters

Some underwriters handle thousands of agents nationally with limited regional support staff. Others structure relationships around dedicated representatives serving specific geographic territories.

Volume matters—an underwriter supporting 500 agents can't provide the same attention as one supporting 50. Your relationship structure determines whether you're one voice in a crowd or a known partner with established credibility.

These benefits don't happen automatically. They're the result of deliberate relationship-building strategies.

How to build a strong partnership as a title agent with your underwriter: 6 key strategies

The difference between week-long waits and same-day answers comes down to specific actions. Here's how to build partnerships that deliver when it matters most.

1. Set clear communication protocols

Strong partnerships require explicit agreements up front:

- Identify your primary contact and backup

- Understand escalation paths for urgent matters

- Set response time expectations for routine vs. priority requests

Knowing exactly who to call—and having them answer—makes the difference between same-day resolution and week-long delays.

Build routine touchpoints, not just emergency contacts. Weekly check-ins during high-volume periods let you flag complex files proactively. Underwriters remember who only calls with problems—routine relationship-building creates goodwill for when you need Friday afternoon priority handling.

Develop templates for common requests to eliminate back-and-forth. One title professional noted that unclear communication—like wire confirmations saying "verified with Bill.com, no last name"—creates confusion that proper templates prevent. Clear documentation standards save time on both sides.

2. Align on compliance and risk standards

Operate from the same playbook. Review underwriter bulletins as they're released, not when problems arise. Title professionals who stay current have substantive conversations rather than playing catch-up during critical moments.

Cover emerging risk areas requiring alignment:

- Wire fraud protocols and verification requirements

- FinCEN beneficial ownership reporting

- Cyber liability and data security standards

- Identity verification for remote transactions

Frame underwriter guidelines as a shared playbook protecting both parties. Create checklists for documentation requirements and high-risk transaction flags—out-of-state sellers, vacant land, LLC transactions. When both sides use the same risk assessment framework, you catch problems early.

When you disagree on risk standards, address it directly. Document your reasoning, cite precedent if available, and escalate through proper channels.

Most underwriters will work with you when you demonstrate you've done your homework. Also, pick your battles and establish yourself as someone who thinks critically about risk rather than pushing boundaries.

3. Foster mutual trust through transparency

Trust develops through proactive information sharing. Send preliminary reports 48+ hours early when possible. Flag potential issues upfront instead of hoping they resolve themselves. Be honest about timeline pressures—your underwriter can't help if they don't know the constraints.

Reliability on routine files builds credibility for urgent requests. Title professionals handling commercial deals note that good underwriter relationships are essential when commitments are longer, with more matters to clear. Your track record on straightforward transactions determines how hard your underwriter will fight for you on complicated ones.

Acknowledge underwriter constraints—audit requirements, claims risk, and regulatory scrutiny. The best relationships feel like "a true partnership" because both sides understand each other's pressures. When you demonstrate you're protecting them from unnecessary risk, they're more willing to take calculated risks with you.

4. Use technology for collaboration

Shared platforms eliminate manual check-ins and create real-time visibility. When underwriters see file status without asking, communication becomes exception-based rather than constant status updates.

Title professionals using production software like Qualia or SoftPro with underwriter integrations report faster disbursements and less manual coordination.

Layering in verification tools like CertifID—which connects directly with the leading TPS platforms—adds another layer of shared visibility across the transaction. The technology creates a shared workspace where both parties track progress.

Technology investment signals you're building for the long term. It shows you're a serious partner rather than a transactional relationship that disappears when pricing changes.

If your underwriter uses different technology, establish clear handoff protocols. Define what information goes through which system, who's responsible for updates, and how you'll handle system failures.

5. Set shared goals and performance metrics

Define success together:

- Exception rates under 5%

- Commitment turnaround within 24-48 hours

- Clean closing rates above your market average

Make it two-way—understand what metrics matter to your underwriter contact and how your performance affects their standing internally. When you help them hit their targets, they prioritize helping you hit yours.

Schedule quarterly business reviews with data to discuss. Bring actual numbers, not just impressions or complaints. "Our exception rate increased 3% this quarter" starts a productive conversation. "Your service is getting worse" doesn't.

6. Handle conflicts proactively

Build escalation paths before you need them. Discuss difficult scenarios in advance:

- Recording rushes when the county's backlogged

- Disputed liens where parties disagree on validity

- Situations where you need underwriter backing to push back on agent pressure for shortcuts

When conflicts arise, address issues directly before escalating. Going over someone's head without warning damages trust that took months to build. Most problems resolve when both parties understand the constraints. Save escalation for genuine impasses, not first-resort solutions.

Real-world signs of a strong partnership

You know the partnership works when you get immediate answers on curative issues. When your underwriter rep won't rest until problems are resolved. When they show genuine interest in your business success, not just policy volume.

One title professional praised getting "a national underwriter with a regional feel"—the resources of a major company with the responsiveness of a local partner.

Strong partnerships make your underwriter an extension of your team. They prioritize your requests because they trust the groundwork you've done. They know you wouldn't call it urgent unless it actually was.

Build and maintain a strong professional relationship with your underwriter

The partnership is about reliable support when deals get complicated—not just policy issuance. The difference between week-long waits and same-day answers comes down to the relationship you built beforehand.

Here’s an actionable step for you: Schedule a check-in with your underwriter contact this week. Review your current exception rate together. Ask what would make their job easier when working with your files.

Strong underwriter partnerships form the foundation of operational excellence. When you've built trust through consistent, professional collaboration, you gain a true partner who protects your business when it matters most.

Fraud prevention companies like CertifID complement these relationships. Major underwriters increasingly partner with verification solutions to protect their agents—adding another layer of security to the strong foundation you've built together.

Subscribe to our newsletter for monthly updates on fraud alerts, security tips, and easy steps you can implement in your business.

FAQ

What's the best way for title agents to communicate with underwriters?

Title professionals working with major underwriters like Stewart, Old Republic, or Westcor note that having a dedicated rep who knows your business makes the difference between getting answers and getting voicemail. Establish your primary contact, set clear response time expectations, and maintain regular touchpoints beyond emergencies.

How can title agents reduce title exceptions?

Flag high-risk transactions early—out-of-state sellers, vacant land, LLC purchases, foreign nationals. Your underwriter can provide guidance before problems surface at closing. Exception rates drop when you catch issues during the search phase rather than at the closing table.

Why should title agents schedule regular check-ins with underwriters?

Underwriters remember who invests in the relationship during routine times versus who only calls during emergencies—and they prioritize accordingly when both are competing for attention.

What documents help ensure smooth title agent-underwriter alignment?

Submit preliminary title reports ahead of deadline with complete supporting documentation. Include curative documentation with all relevant records attached. Flag high-risk transactions with specific risk factors identified. Use compliance checklists aligned with current underwriter guidelines to ensure nothing's missing.

VP of Partnerships

Peter Engleman is the VP of Partnerships at CertifID, where he drives growth through strategic alliances and a global partner ecosystem. With over a decade of experience as a SaaS executive and GTM leader, Peter has built high-performing sales teams, developed partnerships with firms like Microsoft, Salesforce, and top consultancies, and led revenue strategy across early- and growth-stage tech companies. At CertifID, he focuses on scalable partner programs, refined go-to-market strategy, and aligning ecosystem efforts to protect more transactions from fraud. He holds an MBA from NYU Stern, with a focus on finance, analytics, and management.

You submit a curative issue at 3:45 PM on a Friday. The buyer's lender deadline is Monday morning. You need underwriting guidance now.

Some title professionals wait 5-7 days for basic title searches or O&E reports. Others describe underwriters who answer immediately and work until the problem's resolved.

This gap isn't random. It reflects the partnership you built before the crisis hit. Building a strong underwriter relationship before you need it ensures responsive support when deals get complicated.

Why the title agent-underwriter partnership matters

Your underwriter does more than issue policies. They handle title searches, clear liens, approve endorsements, guide you through curative matters, protect against claims, and support complex transactions.

They're your risk partners who determine whether you close on time or scramble to explain delays.

When the partnership is weak, you face:

- Last-minute exceptions that delay closings and frustrate all parties

- Unclear or delayed curative guidance that leaves you exposed and uncertain how to proceed

- Getting caught between underwriter compliance requirements and pressure from agents to close quickly

- The blame game when deals fall through—one title professional described being required to disclose pending condo assessments, only to have the listing agent blame them for "throwing the deal" even though they followed proper protocol

Strong partnerships change everything:

- Commitment turnaround in 24-48 hours instead of 5-7 days

- Direct lines to underwriters who already know your business and transaction patterns

- Proactive guidance on commercial deals or LLC purchases before problems surface

Beyond speed metrics, the real value is having a partner who understands your volume, your market, and your specific challenges. Someone who advocates for your urgent requests internally because they know you and trust your work.

Why response times vary across underwriters

Some underwriters handle thousands of agents nationally with limited regional support staff. Others structure relationships around dedicated representatives serving specific geographic territories.

Volume matters—an underwriter supporting 500 agents can't provide the same attention as one supporting 50. Your relationship structure determines whether you're one voice in a crowd or a known partner with established credibility.

These benefits don't happen automatically. They're the result of deliberate relationship-building strategies.

How to build a strong partnership as a title agent with your underwriter: 6 key strategies

The difference between week-long waits and same-day answers comes down to specific actions. Here's how to build partnerships that deliver when it matters most.

1. Set clear communication protocols

Strong partnerships require explicit agreements up front:

- Identify your primary contact and backup

- Understand escalation paths for urgent matters

- Set response time expectations for routine vs. priority requests

Knowing exactly who to call—and having them answer—makes the difference between same-day resolution and week-long delays.

Build routine touchpoints, not just emergency contacts. Weekly check-ins during high-volume periods let you flag complex files proactively. Underwriters remember who only calls with problems—routine relationship-building creates goodwill for when you need Friday afternoon priority handling.

Develop templates for common requests to eliminate back-and-forth. One title professional noted that unclear communication—like wire confirmations saying "verified with Bill.com, no last name"—creates confusion that proper templates prevent. Clear documentation standards save time on both sides.

2. Align on compliance and risk standards

Operate from the same playbook. Review underwriter bulletins as they're released, not when problems arise. Title professionals who stay current have substantive conversations rather than playing catch-up during critical moments.

Cover emerging risk areas requiring alignment:

- Wire fraud protocols and verification requirements

- FinCEN beneficial ownership reporting

- Cyber liability and data security standards

- Identity verification for remote transactions

Frame underwriter guidelines as a shared playbook protecting both parties. Create checklists for documentation requirements and high-risk transaction flags—out-of-state sellers, vacant land, LLC transactions. When both sides use the same risk assessment framework, you catch problems early.

When you disagree on risk standards, address it directly. Document your reasoning, cite precedent if available, and escalate through proper channels.

Most underwriters will work with you when you demonstrate you've done your homework. Also, pick your battles and establish yourself as someone who thinks critically about risk rather than pushing boundaries.

3. Foster mutual trust through transparency

Trust develops through proactive information sharing. Send preliminary reports 48+ hours early when possible. Flag potential issues upfront instead of hoping they resolve themselves. Be honest about timeline pressures—your underwriter can't help if they don't know the constraints.

Reliability on routine files builds credibility for urgent requests. Title professionals handling commercial deals note that good underwriter relationships are essential when commitments are longer, with more matters to clear. Your track record on straightforward transactions determines how hard your underwriter will fight for you on complicated ones.

Acknowledge underwriter constraints—audit requirements, claims risk, and regulatory scrutiny. The best relationships feel like "a true partnership" because both sides understand each other's pressures. When you demonstrate you're protecting them from unnecessary risk, they're more willing to take calculated risks with you.

4. Use technology for collaboration

Shared platforms eliminate manual check-ins and create real-time visibility. When underwriters see file status without asking, communication becomes exception-based rather than constant status updates.

Title professionals using production software like Qualia or SoftPro with underwriter integrations report faster disbursements and less manual coordination.

Layering in verification tools like CertifID—which connects directly with the leading TPS platforms—adds another layer of shared visibility across the transaction. The technology creates a shared workspace where both parties track progress.

Technology investment signals you're building for the long term. It shows you're a serious partner rather than a transactional relationship that disappears when pricing changes.

If your underwriter uses different technology, establish clear handoff protocols. Define what information goes through which system, who's responsible for updates, and how you'll handle system failures.

5. Set shared goals and performance metrics

Define success together:

- Exception rates under 5%

- Commitment turnaround within 24-48 hours

- Clean closing rates above your market average

Make it two-way—understand what metrics matter to your underwriter contact and how your performance affects their standing internally. When you help them hit their targets, they prioritize helping you hit yours.

Schedule quarterly business reviews with data to discuss. Bring actual numbers, not just impressions or complaints. "Our exception rate increased 3% this quarter" starts a productive conversation. "Your service is getting worse" doesn't.

6. Handle conflicts proactively

Build escalation paths before you need them. Discuss difficult scenarios in advance:

- Recording rushes when the county's backlogged

- Disputed liens where parties disagree on validity

- Situations where you need underwriter backing to push back on agent pressure for shortcuts

When conflicts arise, address issues directly before escalating. Going over someone's head without warning damages trust that took months to build. Most problems resolve when both parties understand the constraints. Save escalation for genuine impasses, not first-resort solutions.

Real-world signs of a strong partnership

You know the partnership works when you get immediate answers on curative issues. When your underwriter rep won't rest until problems are resolved. When they show genuine interest in your business success, not just policy volume.

One title professional praised getting "a national underwriter with a regional feel"—the resources of a major company with the responsiveness of a local partner.

Strong partnerships make your underwriter an extension of your team. They prioritize your requests because they trust the groundwork you've done. They know you wouldn't call it urgent unless it actually was.

Build and maintain a strong professional relationship with your underwriter

The partnership is about reliable support when deals get complicated—not just policy issuance. The difference between week-long waits and same-day answers comes down to the relationship you built beforehand.

Here’s an actionable step for you: Schedule a check-in with your underwriter contact this week. Review your current exception rate together. Ask what would make their job easier when working with your files.

Strong underwriter partnerships form the foundation of operational excellence. When you've built trust through consistent, professional collaboration, you gain a true partner who protects your business when it matters most.

Fraud prevention companies like CertifID complement these relationships. Major underwriters increasingly partner with verification solutions to protect their agents—adding another layer of security to the strong foundation you've built together.

Subscribe to our newsletter for monthly updates on fraud alerts, security tips, and easy steps you can implement in your business.

VP of Partnerships

Peter Engleman is the VP of Partnerships at CertifID, where he drives growth through strategic alliances and a global partner ecosystem. With over a decade of experience as a SaaS executive and GTM leader, Peter has built high-performing sales teams, developed partnerships with firms like Microsoft, Salesforce, and top consultancies, and led revenue strategy across early- and growth-stage tech companies. At CertifID, he focuses on scalable partner programs, refined go-to-market strategy, and aligning ecosystem efforts to protect more transactions from fraud. He holds an MBA from NYU Stern, with a focus on finance, analytics, and management.

Sign up for The Wire to join the conversation.

.png)

.png)