Digital payment security: Protecting real estate transactions

Generic security tools leave real estate transactions exposed. Learn how purpose-built fraud prevention protects your deals and enhances client relationships.

Luis Palomares

6

Digital Payments

Jul 24, 2025

Aug 13, 2025

A law firm thought they had done everything right.

Their digital payment system had bank-level encryption and multi-factor authentication.

Then disaster struck. A client's $450,000 down payment disappeared instantly. The funds were diverted to fraudulent accounts through a sophisticated payment redirection scheme.

Standard security measures weren't enough.

This scenario repeats across the real estate industry. According to a survey conducted by ALTA, 17% of title companies report funds sent to fraudulent accounts and industry losses approaching $500 million annually.

For title companies and law firms handling property transactions, generic payment security simply falls short.

The complex ecosystem of real estate deals—with multiple parties, tight deadlines, high-value transfers, and manual processes like earnest money collection—creates vulnerabilities that standard security tools weren't designed to address.

The solution isn't better encryption or stronger passwords. It's purpose-built protection designed specifically for real estate's unique risks and workflows.

What is digital payment security and why is it important?

Digital payment security protects financial transactions across digital networks.

It combines various technologies and measures to verify participants and information. These safeguards ensure legitimate processing of payments. They provide critical defense against fraud and unauthorized access.

These security measures aim to prevent fraud, unauthorized access, and other security risks associated with online and digital transactions. They include protocols that safeguard financial data throughout the entire transaction process.

Business email compromise was once the primary concern.

Today, more sophisticated impersonation schemes have emerged as the dominant threat.

Fraudsters now directly impersonate trusted parties—title agencies, lenders, sellers, or buyers—depending on their target within the transaction.

What makes real estate transactions particularly vulnerable? Consider the combination of factors at play:

- High-value transfers often exceed hundreds of thousands of dollars.

- Multiple parties involved (buyers, sellers, agents, attorneys, title companies)

- Manual process like earnest money collection create multiple failure points

- Timing pressure to complete transactions by specific deadlines.

- Sensitive personal and financial information exchanged throughout the process.

- Reliance on digital communications across various platforms.

- First-time homebuyers unfamiliar with the process and vulnerable to confusion

.png)

This complex ecosystem creates numerous attack surfaces for fraudsters to exploit.

General digital payment security focuses broadly on protecting any online transaction. Real estate transactions require protection tailored to their unique workflows and vulnerabilities—from initial earnest money deposits through final disbursements.

Importance of digital payment security

.png)

The importance of digital payment security extends far beyond preventing financial loss. It encompasses:

- Protecting consumers from identity theft and financial devastation: For most Americans, a home purchase represents their largest single financial transaction. Losing these funds can be life-altering.

- Maintaining integrity in real estate transactions: When fraud occurs, closings get delayed, deals fall through, and the ripple effects impact multiple parties—from the individuals involved to the broader market.

- Shielding businesses from reputational damage and liability: Law firms and title companies that fall victim to fraud face immediate financial losses and potential lawsuits, insurance complications, and lasting reputational damage.

- Supporting the broader economy: With real estate transactions contributing 15-18% to GDP, protecting these transfers helps maintain market stability.

For title companies and law firms, digital payment security delivers concrete benefits.

Clients increasingly expect protection for their largest financial transactions. Our research shows 79% of home buyers prefer working with security-focused companies. With wire fraud losses averaging $170,000-$275,000 per incident, implementing proper safeguards pays for itself immediately.

Common digital payment security risks in real estate

Learn what type of frauds can occur in real estate not to fall victim.

Check fraud and traditional payment chaos

The outdated earnest money deposit collection process creates a perfect storm of fraud opportunities.

Physical checks can be intercepted, altered, or lost in transit, while complex wire instructions confuse first-time homebuyers who make up a significant portion of the market.

Real estate agents become overwhelmed fielding panicked buyer questions about where to send money, often leading to rushed decisions under pressure.

Imagine the chaos involving buyers visiting banks, deciphering confusing instructions, and agents playing frantic intermediary. It all creates numerous fraud opportunities while delivering a bad client experience.

Seller impersonation fraud

Perhaps the most insidious form of fraud targeting real estate transactions is seller impersonation scam.

Criminals research properties—particularly vacant lots and properties with out-of-state owners—using publicly available records to gather information. They then approach real estate agents or title companies purporting to be the legitimate owners.

These schemes often work because fraudsters create urgency ("I need to sell quickly due to financial hardship") and target properties where in-person verification is difficult.

They've become increasingly sophisticated, combining elements of real identification with falsified information to create "synthetic identities" that can bypass basic verification steps.

Detecting these frauds requires more than just checking ID documents, which can be falsified. Security solutions must verify multiple aspects of identity, including device information, knowledge-based authentication, and biometric verification.

Listen to a story about how CertifID protected the Pacific Northwest Title of Kitsap County from seller impersonation fraud.

Business impersonation

Another growing threat is business impersonation, where fraudsters create sophisticated clones of legitimate title company, law firm, or lender websites.

These fake sites might look identical to the real ones but have slightly altered contact information that routes communication to the criminals.

The level of detail in these impersonation attempts is remarkable.

Fraudsters now research regional accents and business terminology to make phone conversations convincing. They create professional-looking documents with legitimate branding but altered wire instructions.

This is particularly dangerous because it exploits the trust between established business relationships. A client or partner who believes they're communicating with a trusted company will be less likely to question wire instructions or payment requests.

.png)

Mortgage payoff fraud

One of the most devastating forms of fraud targets mortgage payoffs. Criminals intercept legitimate payoff statements and alter the bank routing information, redirecting funds meant to pay off existing mortgages into fraudulent accounts.

These attacks are particularly harmful because they can leave homeowners in a terrible position—believing their mortgage has been paid off when the funds have actually been diverted.

The seller has lost their proceeds, yet still owes their original mortgage, creating a complex legal and financial nightmare.

Payoff fraud is increasing in frequency, with new attempts occurring weekly. Without specialized verification systems for mortgage payoffs, these frauds can be difficult to detect until it's too late.

.png)

Trust and endowment impersonation

A more specialized but growing form of fraud involves impersonating trusts and endowments that own real estate.

These financial instruments often have named representatives who manage transactions, creating another layer of complexity in verification.

Because these organizations aren't traditional businesses, verifying their legitimacy presents unique challenges. Standard business verification processes may not apply, and representatives may be located in different locations than the properties being transacted.

This type of fraud particularly targets high-value properties and relies on the confusion around verifying unconventional ownership structures to succeed.

.png)

Technologies used to protect digital payments

Take a look at the most popular technologies that protect the security of your payments.

Encryption and tokenization

While encryption remains fundamental to digital security, protecting data during transmission isn't enough for real estate transactions.

Standard encryption protects data in transit but doesn't verify the legitimacy of the parties or the accuracy of the information being exchanged.

Real estate security requires additional layers beyond basic encryption, focusing not just on data protection but on verification of all parties and instructions throughout the process.

Multi-factor authentication (MFA)

Multi-factor authentication verifies identities through multiple methods, typically combining something you know (password), something you have (device), and something you are (biometric verification).

In real estate transactions, effective MFA must extend beyond simple password and code verification.

It should include device analysis that flags suspicious locations, new devices, or known risk indicators. For example, a sudden login from overseas when all previous activity has been domestic should trigger enhanced verification.

Knowledge-based authentication (KBA)

Knowledge-based authentication presents dynamically generated questions based on information that only the legitimate person would know, such as past addresses, loan history, or vehicles owned.

Unlike static security questions, these are pulled from multiple databases and change with each verification attempt.

This approach provides stronger security than checking identification documents, which can be falsified.

Modern KBA systems use time limits and multiple questions to prevent research-based circumvention, making it difficult for fraudsters to successfully impersonate legitimate parties.

Automated verification systems

The limitations of manual verification have become increasingly apparent.

Phone callbacks to verify wire instructions—once considered a best practice—are now vulnerable to sophisticated voice impersonation and call forwarding schemes.

Modern security requires automated systems that can verify information against comprehensive databases of known legitimate entities. These systems can instantly validate whether wire instructions match known good accounts, flagging discrepancies for human review.

The most effective approach combines automated verification with specialized human review for exceptions. This hybrid model provides both the efficiency of automation and the nuanced judgment of trained security professionals.

6 best practices for securing digital payments in real estate

Take a look at tips that will help you send money more securely.

.png)

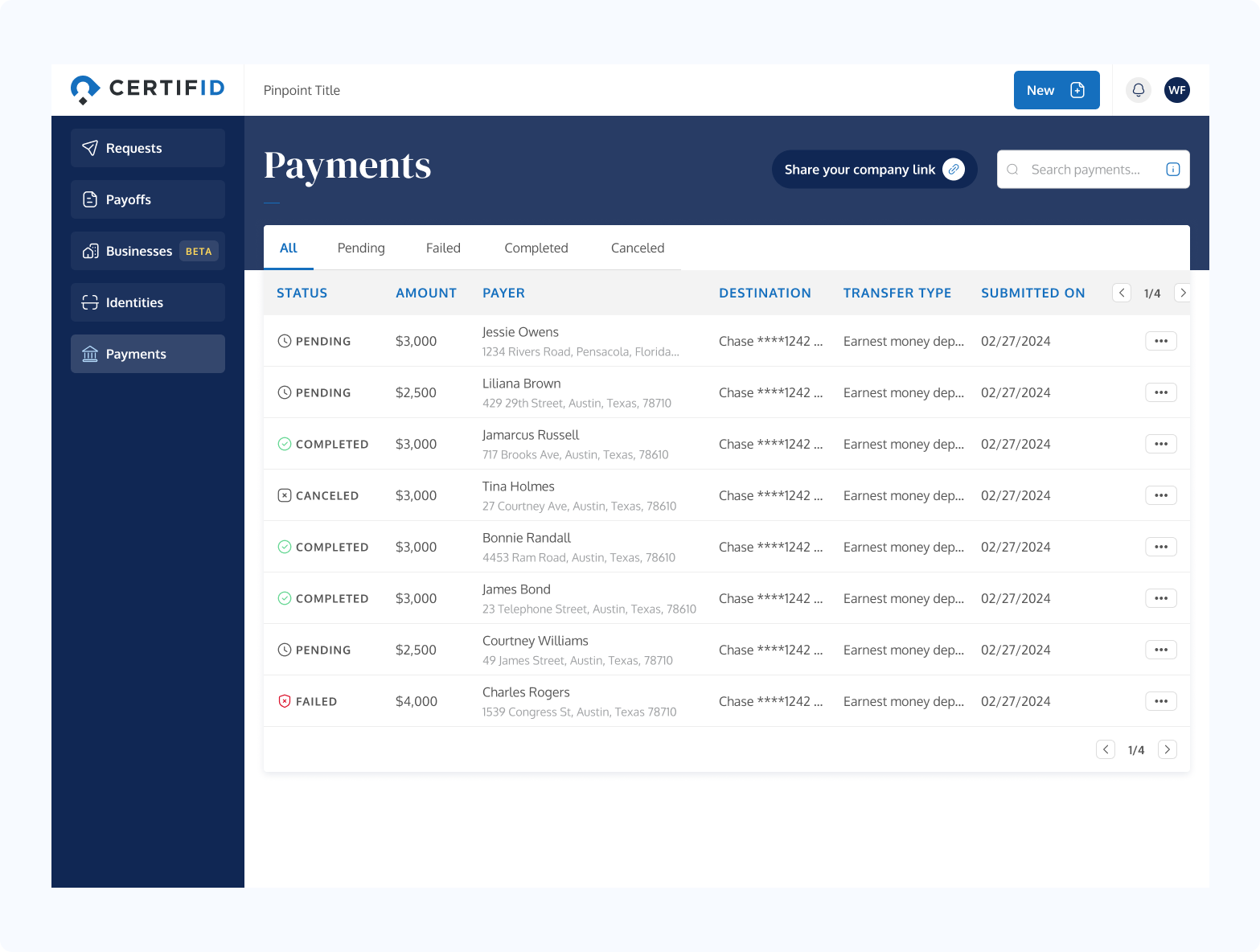

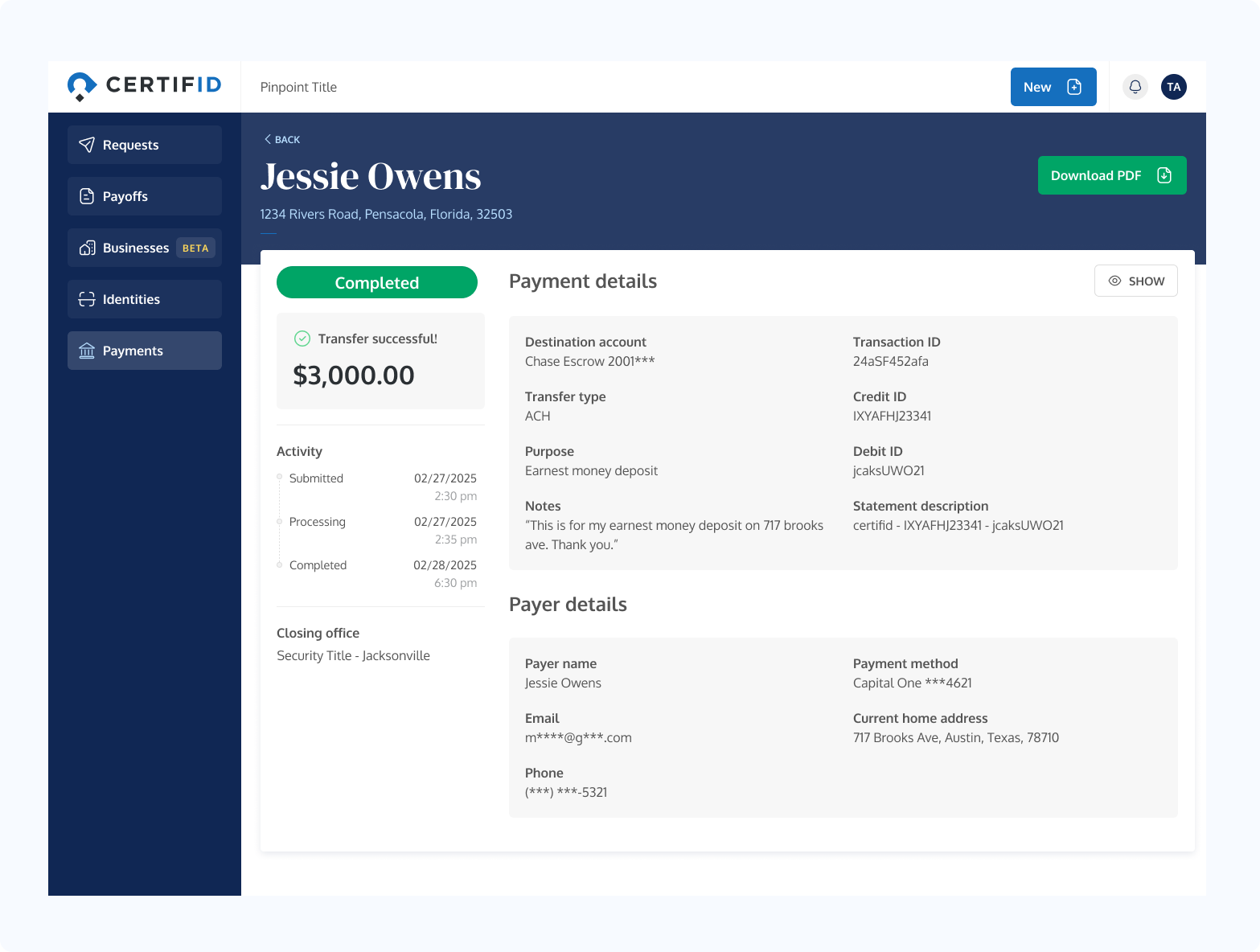

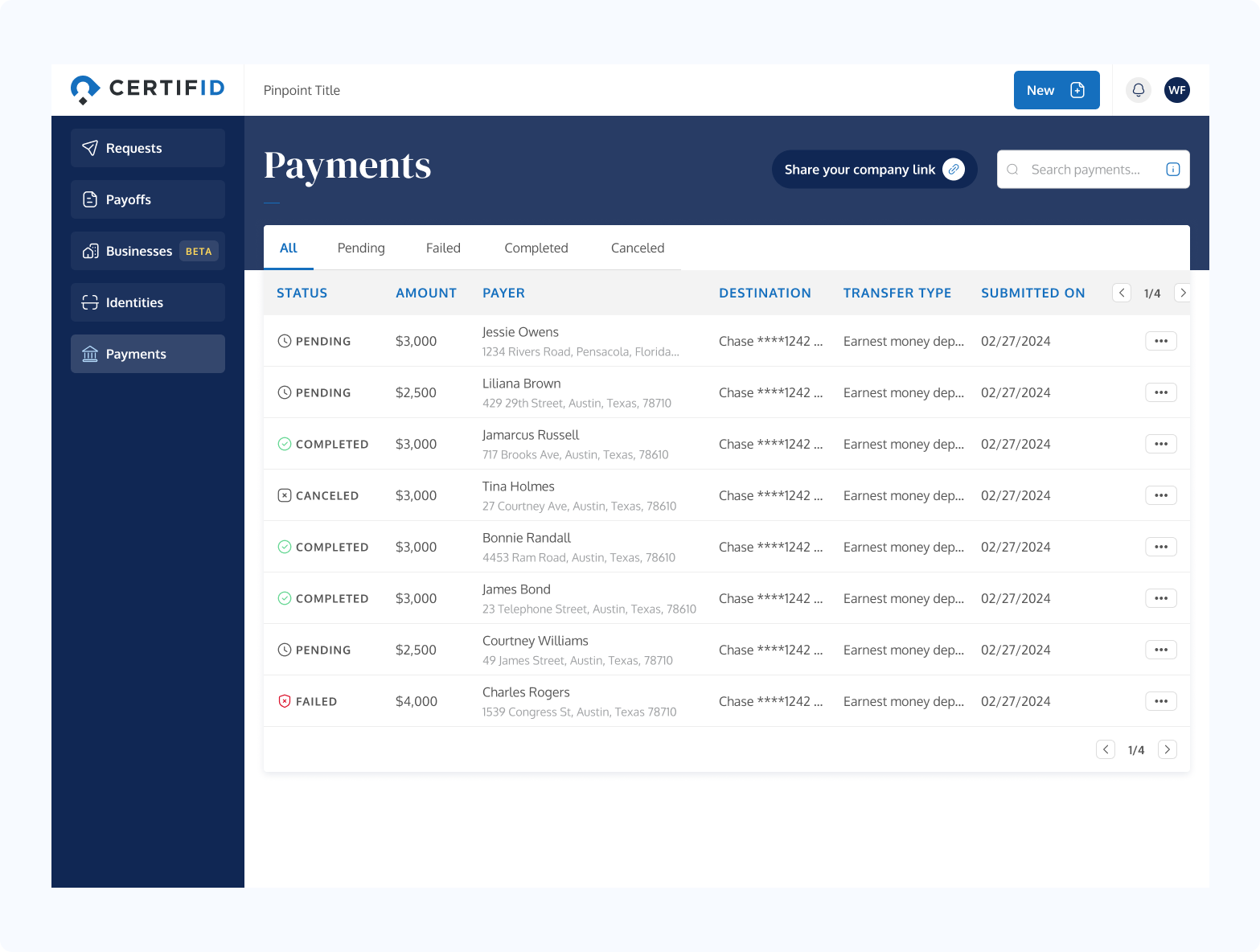

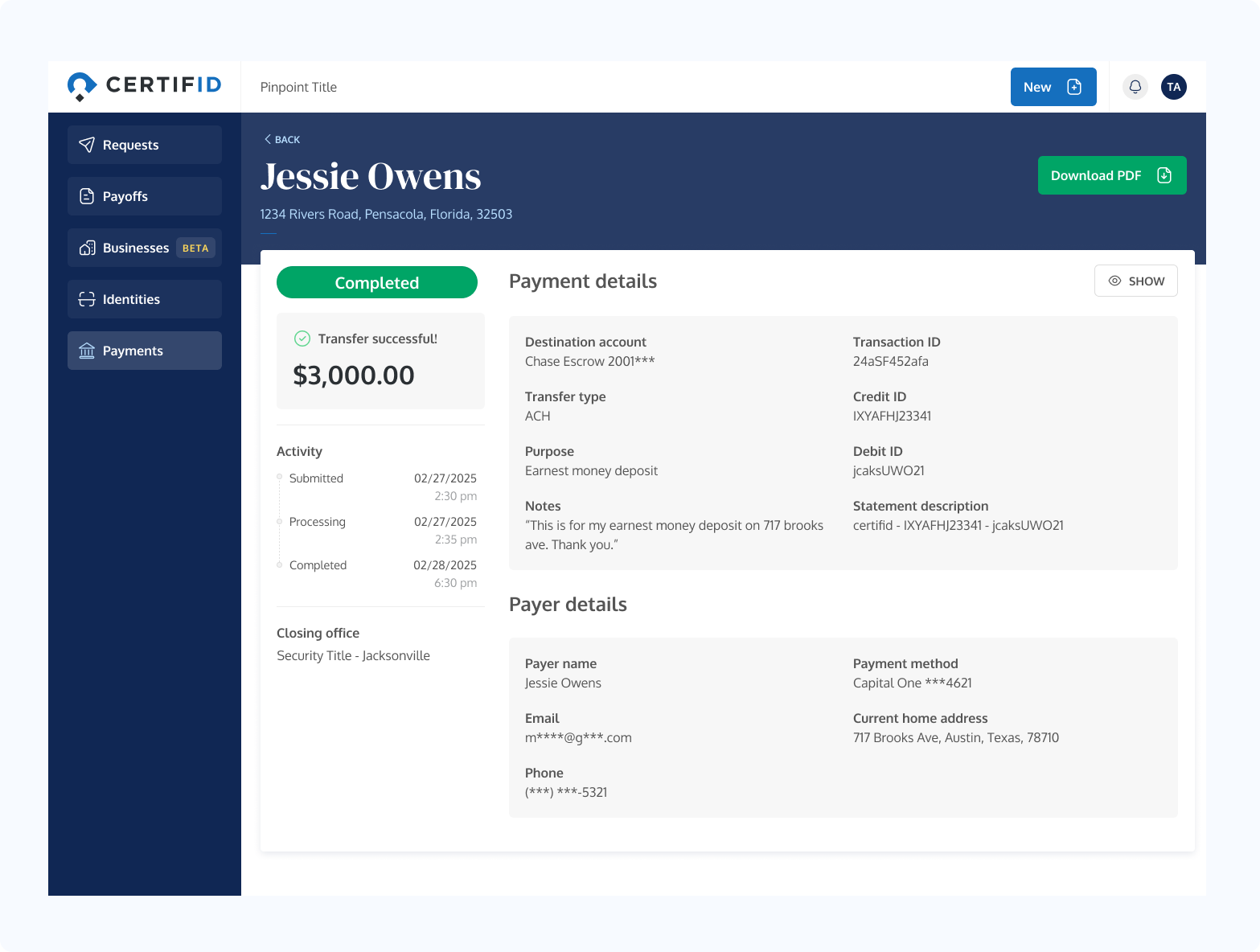

1. Modernize earnest money deposits with secure digital payments

Traditional earnest money collection creates vulnerabilities: lost checks or compromised wire instructions. Purpose-built digital payment solutions eliminate these risks while improving the experience for all parties.

Instead of juggling panicked phone calls from confused buyers and tracking down lost checks, escrow teams can now manage everything from a single dashboard. Every transaction appears with complete details—status, amounts, payer information, and submission dates.

The new buyer experience is remarkably simple: They receive a secure payment link, click it, and submit their deposit in minutes. No bank visits, no wire instruction confusion, no software downloads required.

Real estate agents love the transformation too. Instead of fielding endless "where do I send my money?" calls, they share one branded link with clear steps. Their buyers get it right the first time, and deals move forward smoothly.

Behind the scenes, every payment creates a complete audit trail with timestamps, transaction IDs, and metadata. Documentation downloads directly for compliance or uploads seamlessly to your title production system.

The result? Chaotic, fraud-prone EMD collection becomes a streamlined, secure process that actually improves relationships with buyers and agents while protecting your business.

2. Use a specialized wire fraud prevention solution

General-purpose security tools aren't equipped to address the specific vulnerabilities of real estate transactions.

Email security and generic payment platforms may provide basic protections, but they lack the specialized features needed to detect and prevent sophisticated real estate fraud.

Purpose-built solutions for real estate offer several key advantages:

- Industry-specific verification processes tailored to real estate workflows.

- Databases of known legitimate entities in the real estate ecosystem.

- Specialized identification of red flags common in real estate fraud.

- Integration with title production software and closing platforms

- Insurance coverage specifically designed for wire fraud

These specialized solutions provide comprehensive protection throughout the transaction lifecycle, from initial client onboarding through final disbursement.

3. Never verify via email

One cardinal rule for digital payment security in real estate: never verify instructions via email.

Email remains one of the most vulnerable communication channels, susceptible to account takeovers, spoofing, and interception.

Secure verification should occur through dedicated platforms with multi-factor authentication, not through email threads that may have been compromised.

All payment instructions should be verified through separate channels with proper authentication before funds are transferred.

.png)

This includes avoiding clicking payment links in emails and ensuring verification occurs through authenticated systems with proper documentation and timestamps. Even a single exception to this rule creates a vulnerability that fraudsters will exploit.

4. Implement security protocols

Standardized security procedures provide protection against human error and inconsistent practices. Every transaction, regardless of size or perceived risk, should follow the same verification protocols.

These protocols should include:

- Consistent identity verification for all transaction participants.

- Multi-step approval for high-value transfers.

- Standard operating procedures for handling exceptions.

- Regular training and updates on emerging fraud tactics.

- Clear documentation of all verification steps.

The most damaging security breaches often occur when normal procedures are bypassed due to time pressure, familiarity with the client, or other factors that lead to exceptions. Consistent application of security protocols is essential.

5. Using industry knowledge networks

Individual companies are at a disadvantage when fighting wire fraud in isolation. Modern security approaches leverage network effects by sharing information about known fraud attempts across the industry.

By participating in these knowledge networks, title companies and law firms benefit from collective intelligence about threats, suspicious patterns, and known fraudulent actors. This collaborative approach helps the entire industry stay ahead of evolving fraud tactics.

These networks become more valuable as participation increases, creating a virtuous cycle of improved security across the ecosystem. Companies that isolate themselves miss out on critical early warnings about new fraud techniques.

6. Secure insurance specifically for wire fraud

Traditional cyber insurance policies often have significant limitations when it comes to wire fraud, including:

- High sub-limits that may cover only a fraction of the loss

- Exclusions for social engineering attacks

- Requirements for specific security controls

- Limited coverage for third-party funds

Specialized wire fraud insurance provides direct first-party coverage specifically designed for these risks. Unlike general cyber policies, these specialized policies can provide up to $2 million per wire in coverage, ensuring businesses are protected even in high-value transactions.

This insurance should complement, not replace, security measures. The best approach combines strong preventative controls with financial protection.

.png)

Protecting your real estate transactions

General-purpose security measures are no longer sufficient to protect against real estate fraud. Specialized solutions designed specifically for the unique challenges of real estate transactions are essential.

The most forward-thinking title companies and law firms are already adopting these approaches, recognizing that security is not just about preventing loss but about providing superior client service and differentiation in a competitive market.

The most effective protection combines:

- Identity verification of all transaction participants.

- Secure platforms for sharing and verifying digital payments

- Automated verification against databases of known legitimate entities.

- Specialized insurance covering wire fraud losses.

- Recovery services with expertise in retrieving diverted funds.

CertifID delivers all these capabilities in one integrated platform, purpose-built for real estate professionals who refuse to compromise on security or client experience.

From streamlined EMD collection to comprehensive wire fraud protection, we're transforming how the industry handles high-value transactions.

FAQ

Director of Product

Luis brings over a decade of design and product leadership experience to the team. Before joining CertifID, Luis co-founded InHouse, a real estate marketing, and data platform. Today, he combines his passion for thoughtful design and his experience in real estate to help create a future safe from wire fraud.

A law firm thought they had done everything right.

Their digital payment system had bank-level encryption and multi-factor authentication.

Then disaster struck. A client's $450,000 down payment disappeared instantly. The funds were diverted to fraudulent accounts through a sophisticated payment redirection scheme.

Standard security measures weren't enough.

This scenario repeats across the real estate industry. According to a survey conducted by ALTA, 17% of title companies report funds sent to fraudulent accounts and industry losses approaching $500 million annually.

For title companies and law firms handling property transactions, generic payment security simply falls short.

The complex ecosystem of real estate deals—with multiple parties, tight deadlines, high-value transfers, and manual processes like earnest money collection—creates vulnerabilities that standard security tools weren't designed to address.

The solution isn't better encryption or stronger passwords. It's purpose-built protection designed specifically for real estate's unique risks and workflows.

What is digital payment security and why is it important?

Digital payment security protects financial transactions across digital networks.

It combines various technologies and measures to verify participants and information. These safeguards ensure legitimate processing of payments. They provide critical defense against fraud and unauthorized access.

These security measures aim to prevent fraud, unauthorized access, and other security risks associated with online and digital transactions. They include protocols that safeguard financial data throughout the entire transaction process.

Business email compromise was once the primary concern.

Today, more sophisticated impersonation schemes have emerged as the dominant threat.

Fraudsters now directly impersonate trusted parties—title agencies, lenders, sellers, or buyers—depending on their target within the transaction.

What makes real estate transactions particularly vulnerable? Consider the combination of factors at play:

- High-value transfers often exceed hundreds of thousands of dollars.

- Multiple parties involved (buyers, sellers, agents, attorneys, title companies)

- Manual process like earnest money collection create multiple failure points

- Timing pressure to complete transactions by specific deadlines.

- Sensitive personal and financial information exchanged throughout the process.

- Reliance on digital communications across various platforms.

- First-time homebuyers unfamiliar with the process and vulnerable to confusion

.png)

This complex ecosystem creates numerous attack surfaces for fraudsters to exploit.

General digital payment security focuses broadly on protecting any online transaction. Real estate transactions require protection tailored to their unique workflows and vulnerabilities—from initial earnest money deposits through final disbursements.

Importance of digital payment security

.png)

The importance of digital payment security extends far beyond preventing financial loss. It encompasses:

- Protecting consumers from identity theft and financial devastation: For most Americans, a home purchase represents their largest single financial transaction. Losing these funds can be life-altering.

- Maintaining integrity in real estate transactions: When fraud occurs, closings get delayed, deals fall through, and the ripple effects impact multiple parties—from the individuals involved to the broader market.

- Shielding businesses from reputational damage and liability: Law firms and title companies that fall victim to fraud face immediate financial losses and potential lawsuits, insurance complications, and lasting reputational damage.

- Supporting the broader economy: With real estate transactions contributing 15-18% to GDP, protecting these transfers helps maintain market stability.

For title companies and law firms, digital payment security delivers concrete benefits.

Clients increasingly expect protection for their largest financial transactions. Our research shows 79% of home buyers prefer working with security-focused companies. With wire fraud losses averaging $170,000-$275,000 per incident, implementing proper safeguards pays for itself immediately.

Common digital payment security risks in real estate

Learn what type of frauds can occur in real estate not to fall victim.

Check fraud and traditional payment chaos

The outdated earnest money deposit collection process creates a perfect storm of fraud opportunities.

Physical checks can be intercepted, altered, or lost in transit, while complex wire instructions confuse first-time homebuyers who make up a significant portion of the market.

Real estate agents become overwhelmed fielding panicked buyer questions about where to send money, often leading to rushed decisions under pressure.

Imagine the chaos involving buyers visiting banks, deciphering confusing instructions, and agents playing frantic intermediary. It all creates numerous fraud opportunities while delivering a bad client experience.

Seller impersonation fraud

Perhaps the most insidious form of fraud targeting real estate transactions is seller impersonation scam.

Criminals research properties—particularly vacant lots and properties with out-of-state owners—using publicly available records to gather information. They then approach real estate agents or title companies purporting to be the legitimate owners.

These schemes often work because fraudsters create urgency ("I need to sell quickly due to financial hardship") and target properties where in-person verification is difficult.

They've become increasingly sophisticated, combining elements of real identification with falsified information to create "synthetic identities" that can bypass basic verification steps.

Detecting these frauds requires more than just checking ID documents, which can be falsified. Security solutions must verify multiple aspects of identity, including device information, knowledge-based authentication, and biometric verification.

Listen to a story about how CertifID protected the Pacific Northwest Title of Kitsap County from seller impersonation fraud.

Business impersonation

Another growing threat is business impersonation, where fraudsters create sophisticated clones of legitimate title company, law firm, or lender websites.

These fake sites might look identical to the real ones but have slightly altered contact information that routes communication to the criminals.

The level of detail in these impersonation attempts is remarkable.

Fraudsters now research regional accents and business terminology to make phone conversations convincing. They create professional-looking documents with legitimate branding but altered wire instructions.

This is particularly dangerous because it exploits the trust between established business relationships. A client or partner who believes they're communicating with a trusted company will be less likely to question wire instructions or payment requests.

.png)

Mortgage payoff fraud

One of the most devastating forms of fraud targets mortgage payoffs. Criminals intercept legitimate payoff statements and alter the bank routing information, redirecting funds meant to pay off existing mortgages into fraudulent accounts.

These attacks are particularly harmful because they can leave homeowners in a terrible position—believing their mortgage has been paid off when the funds have actually been diverted.

The seller has lost their proceeds, yet still owes their original mortgage, creating a complex legal and financial nightmare.

Payoff fraud is increasing in frequency, with new attempts occurring weekly. Without specialized verification systems for mortgage payoffs, these frauds can be difficult to detect until it's too late.

.png)

Trust and endowment impersonation

A more specialized but growing form of fraud involves impersonating trusts and endowments that own real estate.

These financial instruments often have named representatives who manage transactions, creating another layer of complexity in verification.

Because these organizations aren't traditional businesses, verifying their legitimacy presents unique challenges. Standard business verification processes may not apply, and representatives may be located in different locations than the properties being transacted.

This type of fraud particularly targets high-value properties and relies on the confusion around verifying unconventional ownership structures to succeed.

.png)

Technologies used to protect digital payments

Take a look at the most popular technologies that protect the security of your payments.

Encryption and tokenization

While encryption remains fundamental to digital security, protecting data during transmission isn't enough for real estate transactions.

Standard encryption protects data in transit but doesn't verify the legitimacy of the parties or the accuracy of the information being exchanged.

Real estate security requires additional layers beyond basic encryption, focusing not just on data protection but on verification of all parties and instructions throughout the process.

Multi-factor authentication (MFA)

Multi-factor authentication verifies identities through multiple methods, typically combining something you know (password), something you have (device), and something you are (biometric verification).

In real estate transactions, effective MFA must extend beyond simple password and code verification.

It should include device analysis that flags suspicious locations, new devices, or known risk indicators. For example, a sudden login from overseas when all previous activity has been domestic should trigger enhanced verification.

Knowledge-based authentication (KBA)

Knowledge-based authentication presents dynamically generated questions based on information that only the legitimate person would know, such as past addresses, loan history, or vehicles owned.

Unlike static security questions, these are pulled from multiple databases and change with each verification attempt.

This approach provides stronger security than checking identification documents, which can be falsified.

Modern KBA systems use time limits and multiple questions to prevent research-based circumvention, making it difficult for fraudsters to successfully impersonate legitimate parties.

Automated verification systems

The limitations of manual verification have become increasingly apparent.

Phone callbacks to verify wire instructions—once considered a best practice—are now vulnerable to sophisticated voice impersonation and call forwarding schemes.

Modern security requires automated systems that can verify information against comprehensive databases of known legitimate entities. These systems can instantly validate whether wire instructions match known good accounts, flagging discrepancies for human review.

The most effective approach combines automated verification with specialized human review for exceptions. This hybrid model provides both the efficiency of automation and the nuanced judgment of trained security professionals.

6 best practices for securing digital payments in real estate

Take a look at tips that will help you send money more securely.

.png)

1. Modernize earnest money deposits with secure digital payments

Traditional earnest money collection creates vulnerabilities: lost checks or compromised wire instructions. Purpose-built digital payment solutions eliminate these risks while improving the experience for all parties.

Instead of juggling panicked phone calls from confused buyers and tracking down lost checks, escrow teams can now manage everything from a single dashboard. Every transaction appears with complete details—status, amounts, payer information, and submission dates.

The new buyer experience is remarkably simple: They receive a secure payment link, click it, and submit their deposit in minutes. No bank visits, no wire instruction confusion, no software downloads required.

Real estate agents love the transformation too. Instead of fielding endless "where do I send my money?" calls, they share one branded link with clear steps. Their buyers get it right the first time, and deals move forward smoothly.

Behind the scenes, every payment creates a complete audit trail with timestamps, transaction IDs, and metadata. Documentation downloads directly for compliance or uploads seamlessly to your title production system.

The result? Chaotic, fraud-prone EMD collection becomes a streamlined, secure process that actually improves relationships with buyers and agents while protecting your business.

2. Use a specialized wire fraud prevention solution

General-purpose security tools aren't equipped to address the specific vulnerabilities of real estate transactions.

Email security and generic payment platforms may provide basic protections, but they lack the specialized features needed to detect and prevent sophisticated real estate fraud.

Purpose-built solutions for real estate offer several key advantages:

- Industry-specific verification processes tailored to real estate workflows.

- Databases of known legitimate entities in the real estate ecosystem.

- Specialized identification of red flags common in real estate fraud.

- Integration with title production software and closing platforms

- Insurance coverage specifically designed for wire fraud

These specialized solutions provide comprehensive protection throughout the transaction lifecycle, from initial client onboarding through final disbursement.

3. Never verify via email

One cardinal rule for digital payment security in real estate: never verify instructions via email.

Email remains one of the most vulnerable communication channels, susceptible to account takeovers, spoofing, and interception.

Secure verification should occur through dedicated platforms with multi-factor authentication, not through email threads that may have been compromised.

All payment instructions should be verified through separate channels with proper authentication before funds are transferred.

.png)

This includes avoiding clicking payment links in emails and ensuring verification occurs through authenticated systems with proper documentation and timestamps. Even a single exception to this rule creates a vulnerability that fraudsters will exploit.

4. Implement security protocols

Standardized security procedures provide protection against human error and inconsistent practices. Every transaction, regardless of size or perceived risk, should follow the same verification protocols.

These protocols should include:

- Consistent identity verification for all transaction participants.

- Multi-step approval for high-value transfers.

- Standard operating procedures for handling exceptions.

- Regular training and updates on emerging fraud tactics.

- Clear documentation of all verification steps.

The most damaging security breaches often occur when normal procedures are bypassed due to time pressure, familiarity with the client, or other factors that lead to exceptions. Consistent application of security protocols is essential.

5. Using industry knowledge networks

Individual companies are at a disadvantage when fighting wire fraud in isolation. Modern security approaches leverage network effects by sharing information about known fraud attempts across the industry.

By participating in these knowledge networks, title companies and law firms benefit from collective intelligence about threats, suspicious patterns, and known fraudulent actors. This collaborative approach helps the entire industry stay ahead of evolving fraud tactics.

These networks become more valuable as participation increases, creating a virtuous cycle of improved security across the ecosystem. Companies that isolate themselves miss out on critical early warnings about new fraud techniques.

6. Secure insurance specifically for wire fraud

Traditional cyber insurance policies often have significant limitations when it comes to wire fraud, including:

- High sub-limits that may cover only a fraction of the loss

- Exclusions for social engineering attacks

- Requirements for specific security controls

- Limited coverage for third-party funds

Specialized wire fraud insurance provides direct first-party coverage specifically designed for these risks. Unlike general cyber policies, these specialized policies can provide up to $2 million per wire in coverage, ensuring businesses are protected even in high-value transactions.

This insurance should complement, not replace, security measures. The best approach combines strong preventative controls with financial protection.

.png)

Protecting your real estate transactions

General-purpose security measures are no longer sufficient to protect against real estate fraud. Specialized solutions designed specifically for the unique challenges of real estate transactions are essential.

The most forward-thinking title companies and law firms are already adopting these approaches, recognizing that security is not just about preventing loss but about providing superior client service and differentiation in a competitive market.

The most effective protection combines:

- Identity verification of all transaction participants.

- Secure platforms for sharing and verifying digital payments

- Automated verification against databases of known legitimate entities.

- Specialized insurance covering wire fraud losses.

- Recovery services with expertise in retrieving diverted funds.

CertifID delivers all these capabilities in one integrated platform, purpose-built for real estate professionals who refuse to compromise on security or client experience.

From streamlined EMD collection to comprehensive wire fraud protection, we're transforming how the industry handles high-value transactions.

Director of Product

Luis brings over a decade of design and product leadership experience to the team. Before joining CertifID, Luis co-founded InHouse, a real estate marketing, and data platform. Today, he combines his passion for thoughtful design and his experience in real estate to help create a future safe from wire fraud.

Sign up for The Wire to join the conversation.