How to find the right online notary: A title company's guide to remote notarization security

Consider these conditions and standards before using remote online notarization.

.png)

Luis Palomares

4

Cybersecurity

Jun 27, 2024

Jul 24, 2025

Nearly every real estate business practice—from depositing checks to wiring funds—has gone digital, but until recently, notarization remained an analog process.

It still required face-to-face interaction and wet signatures because notaries verify the authenticity of signatures and the identities of signers.

During the COVID-19 pandemic, however, the need for safe and virtual notary services hastened the widespread adoption of a relatively new process: Remote online notarization (RON).

Now legal in 47 out of 50 states, getting documents notarized is more convenient and accessible than ever before.

RON, however, isn’t a foolproof solution to preventing wire fraud.

With seller impersonation schemes and other fraud on the rise, it’s more important than ever to partner with remote online notaries who can spot the signs of criminal activity and prevent it from taking place.

Key takeaways

- RON requires verification beyond standard platform security measures.

- Multiple authentication methods must be used to confirm notary and signer identities.

- CertifID Match provides comprehensive verification with insurance protection for secure transactions.

- Title companies can integrate advanced identity verification with existing RON workflows.

What is RON?

Notaries executing RON use a secure, two-way recorded audio-visual session to verify a signer’s identity and signature.

The signer confirms their identity by showing their ID document, such as their driver's license or passport, to their webcam or by uploading a photo.

The signer must also answer the remote online notary's knowledge-based questions, such as verifying unique details from their credit report.

The notary then applies the notarial seal electronically, rather than via the physical imprint used in person.

The map below shows how different states currently regulate RON, reflecting a mix of permanent laws, temporary authorizations, and restrictions.

.png)

How to verify an online notary

It’s crucial to find a trusted remote online notary, one who understands the risks of RON and eagerly provides you with additional verification and protection. Your notary should pass the following checks:

Proper credentials and licensing

Legitimate remote online notaries hold valid notary commissions in their state(s) of operations. Check to see if they’re specifically authorized to perform RON through your state’s notary division website.

They should also have professional websites with clear contact information. Their websites should list transparent pricing and service information, and display their notary commission details visibly.

Bonus points if they have verifiable customer reviews and/or testimonials!

Technology compliance and security

Responsible online notaries will follow industry best practices and use a combination of different technologies that safeguard against potential fraudsters.

Firstly, they should implement ID validation tools to ensure parties are who they say they are. It’s also a great sign if they use multifactor authentication to join the virtual notary appointment, which only grants entry to participants who have already proven their identities.

Online notaries should also use approved meeting software for the secure audio-visual session. Bonus points if they use encrypted meeting software, which ensures that connections cannot be intercepted by cybercriminals.

They should also utilize proper digital signature and electronic notary seal technology, and issue tamper-evident electronic documents.

Lastly, online notaries are required by law to create and maintain airtight records of the signing session. Good RON platforms feature encrypted, password-protected electronic journals where notaries can store records for future reference.

Finding an online notary who adheres to these compliance and security measures will reduce the risk of fraud in your real estate transactions.

Legal awareness

RON is a newer process, but legitimate online notaries will have a strong working knowledge of related laws and should be able to explain them clearly to clients, too.

Depending on your state or county, some documents cannot legally be notarized online. For example, some recording offices will not accept digitally notarized deeds. Or, some lenders may not accept promissory notes or closing disclosures that were notarized online.

To avoid hiccups down the road in your transaction, it’s imperative to work with an online notary that knows what can and cannot be notarized digitally. And they should also be familiar with interstate recognition requirements.

Professional conduct

Notaries handle sensitive information and documents, and must maintain impartiality and confidentiality. They should not notarize suspicious documents or offer unsolicited legal opinions.

While fraudsters often write with strange language and grammatical idiosyncrasies, breaking professional best practices, a legitimate remote online notary will use professional and expert language.

The limitations of standard RON platforms for title companies

Even if your online notary passes all of the above checks, RON can still create opportunities for fraudsters to hijack real estate transactions and drain your clients’ bank accounts.

Most standard RON platforms rely on simple ID validation to confirm that parties are who they say they are. The ID validation process establishes the authenticity of an ID document—for example a driver’s license.

ID validation solutions, then, check the integrity of an ID document by comparing it against a library of other legitimate documents, ensuring that there are no discrepancies or signs of tampering.

This kind of software can weed out some images that have been manipulated by fraudsters—but it can’t actually prove that an ID document matches the identity of the transaction participant, nor is it 100% foolproof against counterfeit IDs.

RON, then, introduces a new security vulnerability for title companies: Fraudsters who have access to real ID documents (or use great fakes) can pass the identity and security checks title companies rely on to legally transfer properties from one party to another.

The growing threat of seller impersonation fraud in RON

We’ll illustrate the vulnerability of remote online notarization with a scenario that’s becoming more and more commonplace for our title and real estate customers.

Let’s say a client has found an incredible deal on a property that is bound to sell, fast. The out-of-town seller insists that the all-cash deal proceed at a quicker-than-usual pace.

The client comes to your title company for help transferring the property rights from the seller. You trace the property title and see that the seller your client has been in communication with has the same name.

Moving rapidly to secure the property for your client, you enlist the help of an online notary to verify the seller’s ID documents.

According to the online notary—who follows best practices, including using standard RON platforms—the seller possesses the necessary ID documents linking them to the property deed, and the deed is notarized.

After the verification process, your client wires the funds to the seller. But the seller, who up until this point has passed checks with flying colors, doesn’t transfer the deed to the property.

Instead, you and your client have just fallen victim to seller impersonation fraud.

How to overcome the limitations of RON: Advanced verification for title companies

Even remote online notaries with proper credentials, strong working knowledge of RON laws, and great ID validation tools can be exploited by technologically-savvy cyber criminals committing seller impersonation fraud.

Beyond the threat of clients losing their life savings, the legal and financial risks of wire fraud to title companies are enormous, especially given how difficult it is to determine liability.

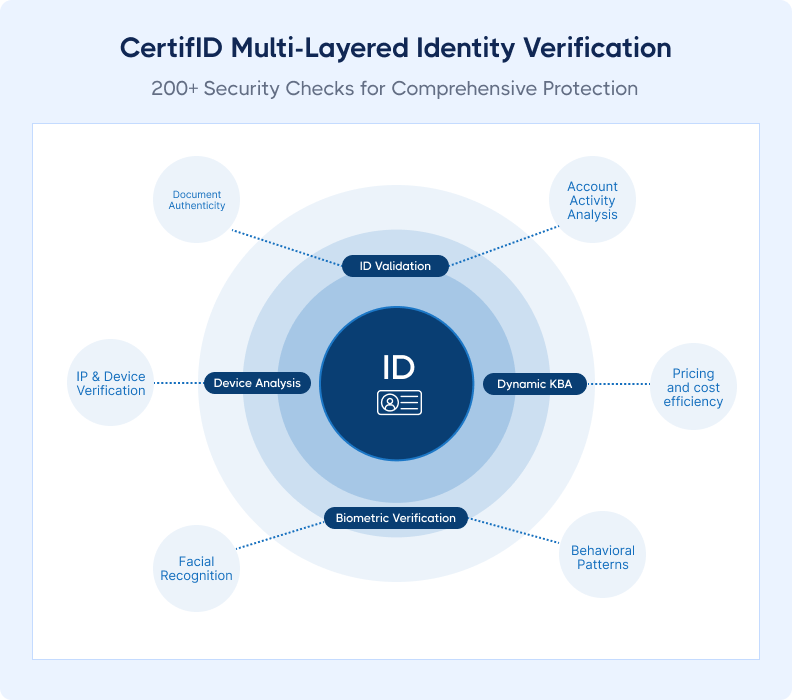

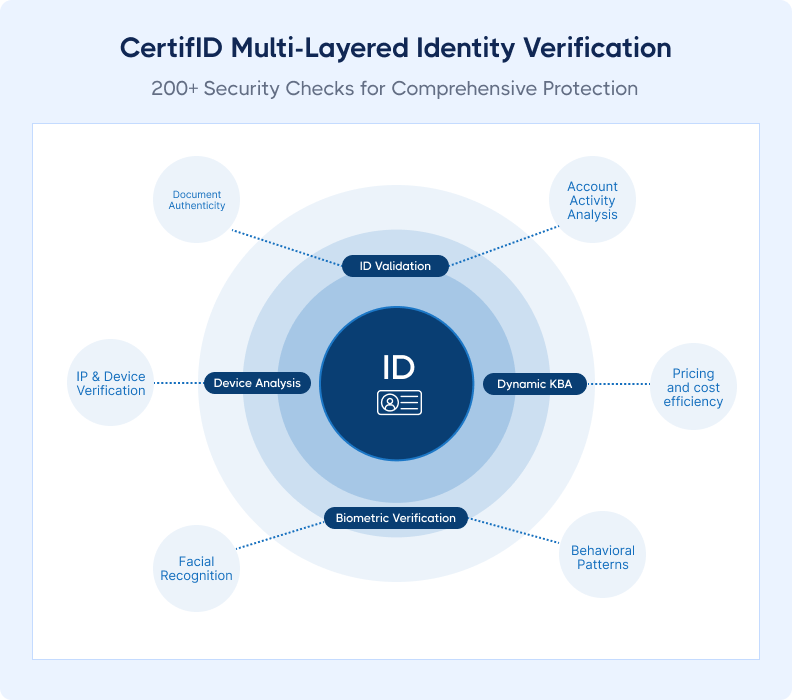

That’s why great notaries complement consistent and compliant anti-fraud processes with identity verification tools like CertifID Match, a trusted authentication platform that verifies IDs and identities in seconds.

According to Experian, “Identity verification is the much more in-depth step of linking an individual to the information they provide.”

Match goes beyond basic ID document validation, performing over 150+ security checks to ensure parties are who their IDs say they are before you move your money anywhere.

Our dynamic authentication procedures and biometric verification processes, which compare ID photos with selfies, are much harder for fraudsters to game. Plus, device and location analysis detect and flag potentially fraudulent behavior.

CertifID is also here to take risk off your shoulders. We stand behind each verified transaction with up to $5M in insurance, so you and your teams can get back to what you love—ensuring great client experiences.

Compliance with legal standards for RON verification

Now that we know how to select an online notary partner whose RON platform comply with industry standards, title companies must also ensure their practices are compliant with RON laws.

Follow state-specific RON requirements

RON laws vary state by state, and title companies must ensure they’re following the rules in the state where the property is located.

This includes confirming that notaries are commissioned and authorized to perform RON in that state, using a state-approved RON platform (if applicable), and ensuring transaction type and documents are eligible for RON.

Choose a RON platform that complies with MISMO standards

The Mortgage Industry Standards Maintenance Organization (MISMO) sets the bar for secure, compliant RON platforms. Its standards cover everything from comprehensive identity verification, tamper-evident document storage, and audio-visual recording.

When choosing a RON platform, look for one that’s MISMO-certified to help ensure transactions are secure and meet the expectations of other parties involved in the transaction.

Check your underwriter’s RON requirements for closings

Even if RON is legal in your state, not every underwriter accepts it. Some may limit the types of documents that can be notarized online, while others may only recognize certain RON platforms as legitimate.

Double-check your underwriter’s policies early on in the process to avoid down-the-line surprises.

Documentation needed for legal protection in case of fraud claims

If your legal transaction ever comes under legal fire, your best defense will come in the form of a clear paper trail. These records will help you prove that the transaction was done properly.

Make sure your online notary records your audio-visual sessions, identity verification logs, and tamper-evident copies of real estate transaction documents that they’ve notarized.

Best practices for title companies using RON

Every title company needs a standardized RON verification protocol to ensure best practices are followed in every real estate transaction and mitigate the threat of fraud.

Now that we’ve walked through the ins and outs of RON, let’s take a look at an example RON verification protocol that sets your clients and staff up for success.

.png)

1. Prepare the documents and conduct all necessary searches

After preparing the necessary legal documents and conducting all searches, you begin your search for a safe and compliant RON platform where buyer and seller can transfer the property deed.

2. Vet the notary's credentials and conduct

You identify an online notary whose credentials check out on your state notary division website. In your communications, the online notary conducts themselves professionally and demonstrates a strong working knowledge of RON.

3. Evaluate the platform’s security

Next, you review the platform technology. They understand that RON isn’t foolproof, and use multifactor authentication and encrypted meeting software as the first line of defense against fraud. They also take identity verification a step further than most other notaries by using CertifID Match, and attest to following state laws for record keeping.

4. Guide participants through the process

The online notary passes your robust checks, meaning it’s time to begin the RON process. The online notary prepares the buyer and seller with what to expect by sharing standard verification steps and outcomes, and the seller receives an invitation to the RON session.

5. Complete the RON session

On the day of, the seller joins the secure audio-visual session by entering a code sent to their personal cell phone. The online notary prompts the seller to upload their government-issued ID and a real-time selfie to Match. In seconds, Match shares back that the seller’s identity is confirmed.

From there, the seller digitally signs the deed and the online notary witnesses and applies their digital seal and signature. The audio-visual session is also recorded and stored, and the digitally-notarized deed is delivered electronically to the buyer, the county recorder’s office (if supported), and your title company.

6. Finalize the transaction

Now, you submit the deed to the appropriate county office as either a digital document or hard-copy, the seller receives funds, and the buyer receives the keys to their new property!

Everyone who handles title and deed transfers at your title company should be able to recognize the signs of a legitimate online notary and a secure RON platform.

They should also know the difference between ID and identity verification, and implement a layered security approach with multiple verification methods.

Use RON safely with CertifID

To mitigate the threat of fraudsters looking to exploit online notaries with real or fake ID documents, title companies can use comprehensive identity verification tools like CertifID Match.

.png)

With CertifID, business leaders can be confident in mitigating risks of wire fraud, despite any threats stemming from a RON data breach or a counterfeit signature.

CertifID integrates with existing title production software platforms and complements virtual notary services that may already be in place.

If you’d like to learn how to integrate CertifID into your business, request a free demo.

FAQ

Director of Product

Luis brings over a decade of design and product leadership experience to the team. Before joining CertifID, Luis co-founded InHouse, a real estate marketing, and data platform. Today, he combines his passion for thoughtful design and his experience in real estate to help create a future safe from wire fraud.

Nearly every real estate business practice—from depositing checks to wiring funds—has gone digital, but until recently, notarization remained an analog process.

It still required face-to-face interaction and wet signatures because notaries verify the authenticity of signatures and the identities of signers.

During the COVID-19 pandemic, however, the need for safe and virtual notary services hastened the widespread adoption of a relatively new process: Remote online notarization (RON).

Now legal in 47 out of 50 states, getting documents notarized is more convenient and accessible than ever before.

RON, however, isn’t a foolproof solution to preventing wire fraud.

With seller impersonation schemes and other fraud on the rise, it’s more important than ever to partner with remote online notaries who can spot the signs of criminal activity and prevent it from taking place.

Key takeaways

- RON requires verification beyond standard platform security measures.

- Multiple authentication methods must be used to confirm notary and signer identities.

- CertifID Match provides comprehensive verification with insurance protection for secure transactions.

- Title companies can integrate advanced identity verification with existing RON workflows.

What is RON?

Notaries executing RON use a secure, two-way recorded audio-visual session to verify a signer’s identity and signature.

The signer confirms their identity by showing their ID document, such as their driver's license or passport, to their webcam or by uploading a photo.

The signer must also answer the remote online notary's knowledge-based questions, such as verifying unique details from their credit report.

The notary then applies the notarial seal electronically, rather than via the physical imprint used in person.

The map below shows how different states currently regulate RON, reflecting a mix of permanent laws, temporary authorizations, and restrictions.

.png)

How to verify an online notary

It’s crucial to find a trusted remote online notary, one who understands the risks of RON and eagerly provides you with additional verification and protection. Your notary should pass the following checks:

Proper credentials and licensing

Legitimate remote online notaries hold valid notary commissions in their state(s) of operations. Check to see if they’re specifically authorized to perform RON through your state’s notary division website.

They should also have professional websites with clear contact information. Their websites should list transparent pricing and service information, and display their notary commission details visibly.

Bonus points if they have verifiable customer reviews and/or testimonials!

Technology compliance and security

Responsible online notaries will follow industry best practices and use a combination of different technologies that safeguard against potential fraudsters.

Firstly, they should implement ID validation tools to ensure parties are who they say they are. It’s also a great sign if they use multifactor authentication to join the virtual notary appointment, which only grants entry to participants who have already proven their identities.

Online notaries should also use approved meeting software for the secure audio-visual session. Bonus points if they use encrypted meeting software, which ensures that connections cannot be intercepted by cybercriminals.

They should also utilize proper digital signature and electronic notary seal technology, and issue tamper-evident electronic documents.

Lastly, online notaries are required by law to create and maintain airtight records of the signing session. Good RON platforms feature encrypted, password-protected electronic journals where notaries can store records for future reference.

Finding an online notary who adheres to these compliance and security measures will reduce the risk of fraud in your real estate transactions.

Legal awareness

RON is a newer process, but legitimate online notaries will have a strong working knowledge of related laws and should be able to explain them clearly to clients, too.

Depending on your state or county, some documents cannot legally be notarized online. For example, some recording offices will not accept digitally notarized deeds. Or, some lenders may not accept promissory notes or closing disclosures that were notarized online.

To avoid hiccups down the road in your transaction, it’s imperative to work with an online notary that knows what can and cannot be notarized digitally. And they should also be familiar with interstate recognition requirements.

Professional conduct

Notaries handle sensitive information and documents, and must maintain impartiality and confidentiality. They should not notarize suspicious documents or offer unsolicited legal opinions.

While fraudsters often write with strange language and grammatical idiosyncrasies, breaking professional best practices, a legitimate remote online notary will use professional and expert language.

The limitations of standard RON platforms for title companies

Even if your online notary passes all of the above checks, RON can still create opportunities for fraudsters to hijack real estate transactions and drain your clients’ bank accounts.

Most standard RON platforms rely on simple ID validation to confirm that parties are who they say they are. The ID validation process establishes the authenticity of an ID document—for example a driver’s license.

ID validation solutions, then, check the integrity of an ID document by comparing it against a library of other legitimate documents, ensuring that there are no discrepancies or signs of tampering.

This kind of software can weed out some images that have been manipulated by fraudsters—but it can’t actually prove that an ID document matches the identity of the transaction participant, nor is it 100% foolproof against counterfeit IDs.

RON, then, introduces a new security vulnerability for title companies: Fraudsters who have access to real ID documents (or use great fakes) can pass the identity and security checks title companies rely on to legally transfer properties from one party to another.

The growing threat of seller impersonation fraud in RON

We’ll illustrate the vulnerability of remote online notarization with a scenario that’s becoming more and more commonplace for our title and real estate customers.

Let’s say a client has found an incredible deal on a property that is bound to sell, fast. The out-of-town seller insists that the all-cash deal proceed at a quicker-than-usual pace.

The client comes to your title company for help transferring the property rights from the seller. You trace the property title and see that the seller your client has been in communication with has the same name.

Moving rapidly to secure the property for your client, you enlist the help of an online notary to verify the seller’s ID documents.

According to the online notary—who follows best practices, including using standard RON platforms—the seller possesses the necessary ID documents linking them to the property deed, and the deed is notarized.

After the verification process, your client wires the funds to the seller. But the seller, who up until this point has passed checks with flying colors, doesn’t transfer the deed to the property.

Instead, you and your client have just fallen victim to seller impersonation fraud.

How to overcome the limitations of RON: Advanced verification for title companies

Even remote online notaries with proper credentials, strong working knowledge of RON laws, and great ID validation tools can be exploited by technologically-savvy cyber criminals committing seller impersonation fraud.

Beyond the threat of clients losing their life savings, the legal and financial risks of wire fraud to title companies are enormous, especially given how difficult it is to determine liability.

That’s why great notaries complement consistent and compliant anti-fraud processes with identity verification tools like CertifID Match, a trusted authentication platform that verifies IDs and identities in seconds.

According to Experian, “Identity verification is the much more in-depth step of linking an individual to the information they provide.”

Match goes beyond basic ID document validation, performing over 150+ security checks to ensure parties are who their IDs say they are before you move your money anywhere.

Our dynamic authentication procedures and biometric verification processes, which compare ID photos with selfies, are much harder for fraudsters to game. Plus, device and location analysis detect and flag potentially fraudulent behavior.

CertifID is also here to take risk off your shoulders. We stand behind each verified transaction with up to $5M in insurance, so you and your teams can get back to what you love—ensuring great client experiences.

Compliance with legal standards for RON verification

Now that we know how to select an online notary partner whose RON platform comply with industry standards, title companies must also ensure their practices are compliant with RON laws.

Follow state-specific RON requirements

RON laws vary state by state, and title companies must ensure they’re following the rules in the state where the property is located.

This includes confirming that notaries are commissioned and authorized to perform RON in that state, using a state-approved RON platform (if applicable), and ensuring transaction type and documents are eligible for RON.

Choose a RON platform that complies with MISMO standards

The Mortgage Industry Standards Maintenance Organization (MISMO) sets the bar for secure, compliant RON platforms. Its standards cover everything from comprehensive identity verification, tamper-evident document storage, and audio-visual recording.

When choosing a RON platform, look for one that’s MISMO-certified to help ensure transactions are secure and meet the expectations of other parties involved in the transaction.

Check your underwriter’s RON requirements for closings

Even if RON is legal in your state, not every underwriter accepts it. Some may limit the types of documents that can be notarized online, while others may only recognize certain RON platforms as legitimate.

Double-check your underwriter’s policies early on in the process to avoid down-the-line surprises.

Documentation needed for legal protection in case of fraud claims

If your legal transaction ever comes under legal fire, your best defense will come in the form of a clear paper trail. These records will help you prove that the transaction was done properly.

Make sure your online notary records your audio-visual sessions, identity verification logs, and tamper-evident copies of real estate transaction documents that they’ve notarized.

Best practices for title companies using RON

Every title company needs a standardized RON verification protocol to ensure best practices are followed in every real estate transaction and mitigate the threat of fraud.

Now that we’ve walked through the ins and outs of RON, let’s take a look at an example RON verification protocol that sets your clients and staff up for success.

.png)

1. Prepare the documents and conduct all necessary searches

After preparing the necessary legal documents and conducting all searches, you begin your search for a safe and compliant RON platform where buyer and seller can transfer the property deed.

2. Vet the notary's credentials and conduct

You identify an online notary whose credentials check out on your state notary division website. In your communications, the online notary conducts themselves professionally and demonstrates a strong working knowledge of RON.

3. Evaluate the platform’s security

Next, you review the platform technology. They understand that RON isn’t foolproof, and use multifactor authentication and encrypted meeting software as the first line of defense against fraud. They also take identity verification a step further than most other notaries by using CertifID Match, and attest to following state laws for record keeping.

4. Guide participants through the process

The online notary passes your robust checks, meaning it’s time to begin the RON process. The online notary prepares the buyer and seller with what to expect by sharing standard verification steps and outcomes, and the seller receives an invitation to the RON session.

5. Complete the RON session

On the day of, the seller joins the secure audio-visual session by entering a code sent to their personal cell phone. The online notary prompts the seller to upload their government-issued ID and a real-time selfie to Match. In seconds, Match shares back that the seller’s identity is confirmed.

From there, the seller digitally signs the deed and the online notary witnesses and applies their digital seal and signature. The audio-visual session is also recorded and stored, and the digitally-notarized deed is delivered electronically to the buyer, the county recorder’s office (if supported), and your title company.

6. Finalize the transaction

Now, you submit the deed to the appropriate county office as either a digital document or hard-copy, the seller receives funds, and the buyer receives the keys to their new property!

Everyone who handles title and deed transfers at your title company should be able to recognize the signs of a legitimate online notary and a secure RON platform.

They should also know the difference between ID and identity verification, and implement a layered security approach with multiple verification methods.

Use RON safely with CertifID

To mitigate the threat of fraudsters looking to exploit online notaries with real or fake ID documents, title companies can use comprehensive identity verification tools like CertifID Match.

.png)

With CertifID, business leaders can be confident in mitigating risks of wire fraud, despite any threats stemming from a RON data breach or a counterfeit signature.

CertifID integrates with existing title production software platforms and complements virtual notary services that may already be in place.

If you’d like to learn how to integrate CertifID into your business, request a free demo.

Director of Product

Luis brings over a decade of design and product leadership experience to the team. Before joining CertifID, Luis co-founded InHouse, a real estate marketing, and data platform. Today, he combines his passion for thoughtful design and his experience in real estate to help create a future safe from wire fraud.

Sign up for The Wire to join the conversation.

.png)

.png)