How to wire money for closing: 6-step guide to avoid fraud

While it might seem intimidating, learning how to wire money for closing is a standard process trusted by more than half a million people every day.

.png)

Katie Stewart

5 minutes

Education

Jul 8, 2021

Feb 5, 2026

Purchasing a home is the culmination of months of effort—comparing options, making offers, scheduling inspections, and securing financing. When it's finally time to close, you need to be prepared to send your Cash to Close payment and seal the deal.

The most efficient way to close is by wiring money electronically. We have moved past the days of handwritten checks or carrying cash to the closing table. But according to the FBI's 2024 Internet Crime Report, real estate wire fraud resulted in over $446 million in losses.

Wire transfers are a secure way to send large sums of money, provided you take specific precautions. Understanding the process and coordinating with your bank will help make this part of the transaction straightforward.

What is a wire transfer and why use it for closing?

A wire transfer—sometimes referred to as a bank transfer, credit transfer, or EFT (Electronic Funds Transfer)—is an electronic movement of money from one financial institution to another. It is a fast way to send funds, as the money is typically available for immediate use within the same or next day.

The SWIFT (Society for Worldwide Interbank Financial Telecommunication) or Fedwire networks are typically used for these transfers, allowing for both international and domestic transactions.

Wire transfers are preferred over checks for real estate closings because they provide speed, verification, and certainty.

Checks can bounce or face delays, but wire transfers are immediate and permanent once processed. Both parties in the transaction must be account holders at their respective institutions. Reputable banks verify a new account holder's identity when opening an account, which adds a layer of protection.

When you'll need to wire money: EMD vs. Cash to Close

There are two points in the home-buying process where you will need to send large sums of money: the Earnest Money Deposit (EMD) and the Cash to Close payment.

An EMD is a deposit you put down to demonstrate your intent to buy the home. This is typically 1% to 3% of the total purchase price. Unlike the down payment paid at closing, the EMD is credited toward your down payment later in the process.

Cash to Close includes your down payment, closing costs, and any other fees, minus credits like your earnest money deposit. Both amounts will vary based on the terms set between you and the title or escrow company. The same wire transfer process applies to both EMD and closing funds.

Now, you’ll check 6 steps to make sure the transaction is successful and safe.

Step 1: Get and verify your wire transfer instructions

You will typically receive these instructions from your title company 2-3 days before closing. The instructions will include the title or escrow company's financial institution name, account number, and routing number or ABA (American Bankers Association) number.

Key insight: Fraud often involves a criminal sending "updated" or "new" wiring instructions to direct funds to a fraudulent account. Always check in with your title company to confirm any changes before proceeding.

Step 2: Confirm your exact cash-to-close amount

Review your closing disclosure carefully to ensure you account for every detail. Cash to Close includes your down payment, closing costs, and fees, minus credits.

Compliance note: If you receive an updated closing disclosure with changes to your Cash to Close amount after initiating a wire, contact both your title company and bank immediately. You may need to send an additional wire for the difference or receive a credit at closing.

Step 3: Initiate the wire transfer through your bank

You can typically initiate a wire transfer through three methods:

- In-person at your bank branch

- Phone with a bank representative

- Online through your bank's portal

Many banks require in-person visits for large sums involved in real estate closings. They may charge a fee of $25-$75 for wiring money. Some banks waive fees for large transactions or premium account holders, so ask about fees when contacting your bank.

You will need the details of the account you are sending money from.

If you do not have this on hand, you can find it online, through your bank's mobile app, or by calling your bank. You will also need a government-issued ID for in-person transfers. Confirm with your bank that the funds are available to transfer. If the money is not available, you will not be able to close.

Step 4: Double-check all wire transfer details before sending

This is your final opportunity to ensure all information is correct before funds leave your account. Verify every digit in the account and routing numbers against your written instructions. Wire transfers cannot be reversed once initiated, so accuracy is critical.

Ask to have the address of the property you are purchasing added to the notes section of the wire transfer summary. This gives the title company more context for the payment when they receive it.

Step 5: Send the wire transfer

Plan to send your wire 1-2 days before closing to ensure funds arrive on time. Wire transfers generally arrive on the same day they are sent, but may arrive the following business day if initiated later in the day. Processing times may extend during holidays or weekends.

Step 6: Confirm receipt and save your federal reference number

Once you send the wire, you will receive a receipt. Keep this record and bring it to closing. The money moves from your bank to a correspondent bank before reaching the recipient.

Federal Reference number: Request the Federal Reference number or "fed ref" number from your bank. This is a 16-20 digit tracking number found on the wire transfer receipt. It tracks the wire like a package in the mail and helps identify it when referencing it with your title or escrow company.

Call the title or escrow company to confirm the transfer and ensure delivery. Provide the exact amount of the wire and the federal reference number to verify the match.

Protect yourself: Final checklist for secure wire transfers

Quick checklist: Wiring money for closing

[ ] Receive wiring instructions from title company

[ ] Review closing disclosure for exact amount

[ ] Contact bank 1-2 days before closing

[ ] Verify all account numbers and routing numbers

[ ] Send wire and obtain Federal Reference number

[ ] Confirm receipt with title company

Recommended timeline:

- 3 days before closing: Receive closing disclosure

- 2 days before closing: Contact bank, verify instructions

- 1 day before closing: Send wire transfer

- Closing day: Confirm receipt, bring wire receipt

While the process of collecting information and sending money is straightforward, criminals actively target these large transactions. Always verify information at each stage and maintain communication with your title or escrow company.

How to verify wiring instructions with CertifID

Many reputable title companies and law practices now use CertifID as a fraud prevention standard in closings.

According to CertifID's State of Wire Fraud 2025 report, over 1 in 4 home buyers and sellers are targeted by fraudsters during their transaction.

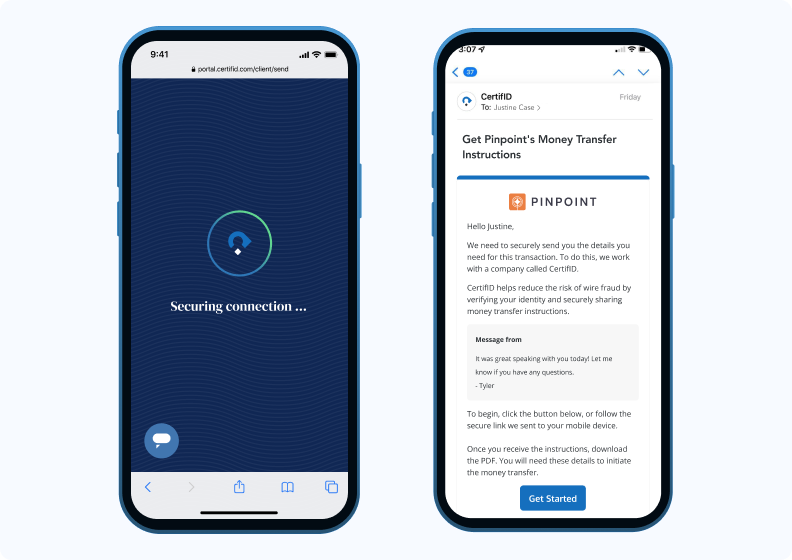

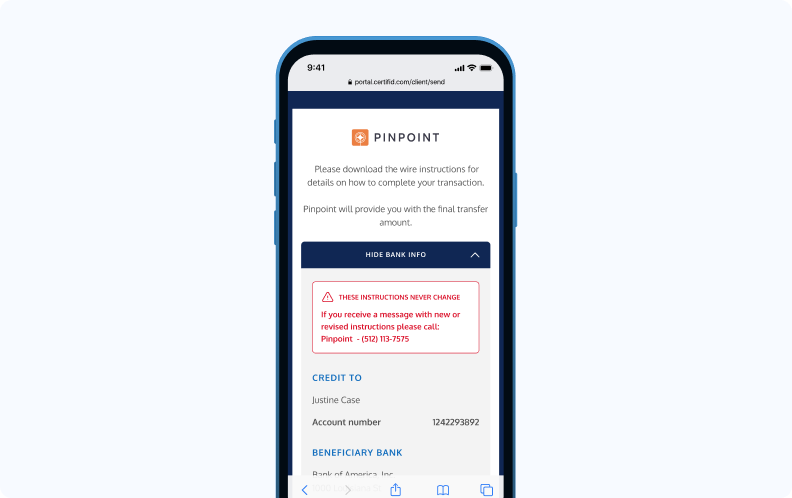

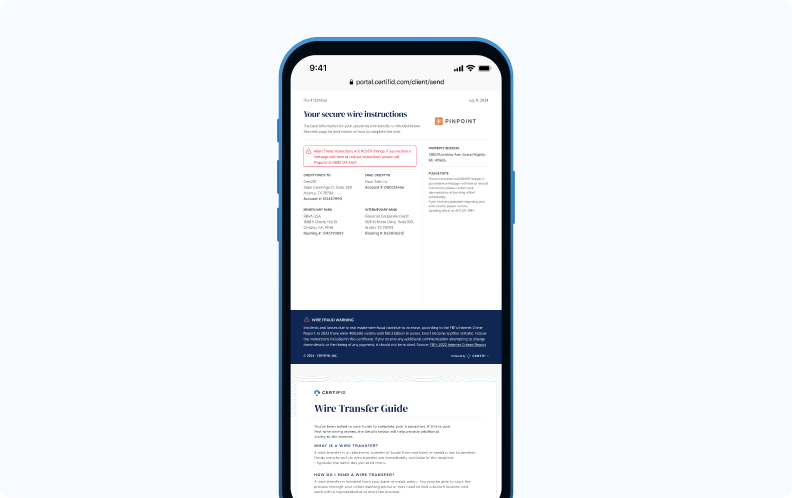

If your title company uses CertifID, you will receive your wiring instructions through a secure, verified channel—not through email, which can be intercepted or spoofed by criminals.

The process takes just a few minutes and does not require you to create an account or remember any passwords.

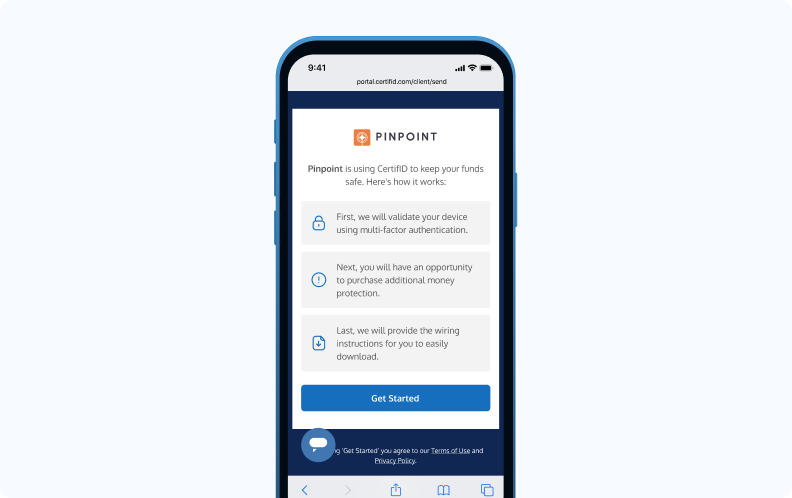

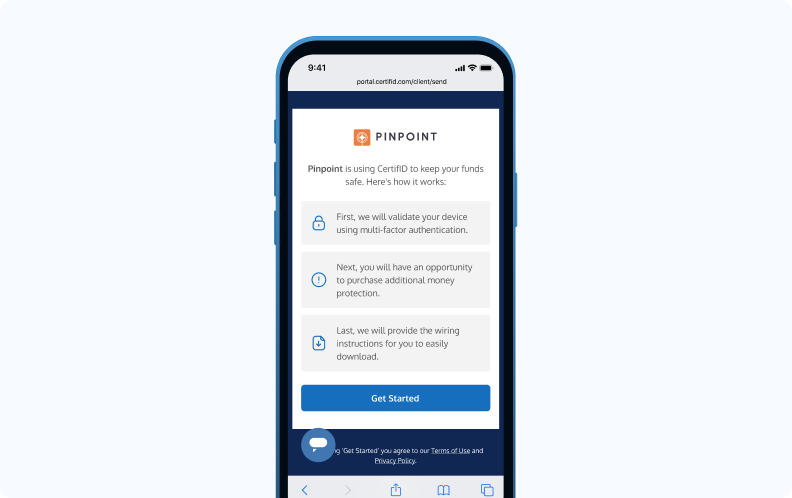

Here is what to expect when your title company sends you a CertifID request.

1. You receive an email and text message.

The message will come from CertifID on behalf of your title company. It will include a personalized note from your closing agent and a secure link to access your wiring instructions. You can complete the process on your phone or computer—whichever is more convenient.

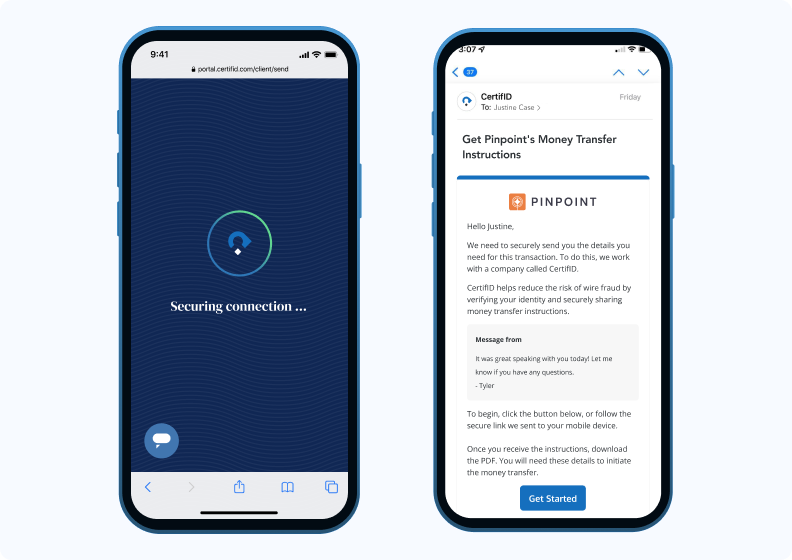

2. CertifID secures the connection and analyzes your device

When you click "Get Started," CertifID analyzes your device for over 150 fraud indicators before proceeding.

This includes checking whether the device is located outside the United States, whether it was recently activated (like a burner phone), and other signals associated with fraudulent activity. If anything looks suspicious, the process stops immediately.

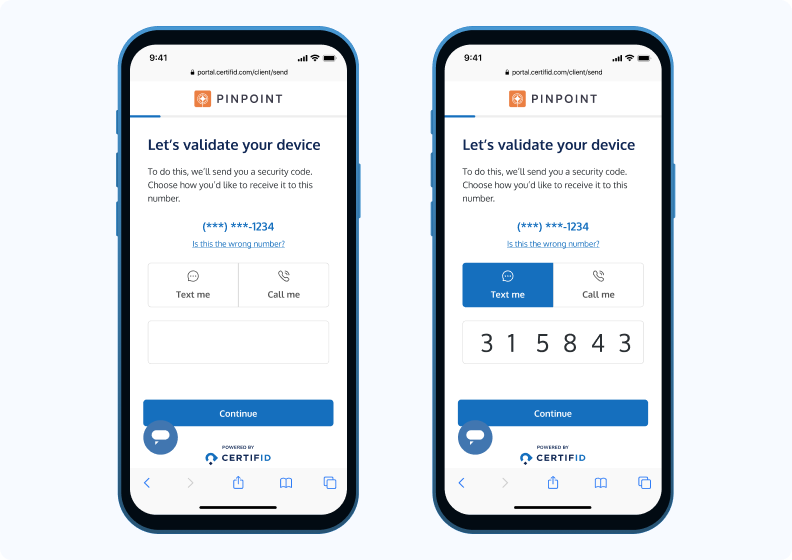

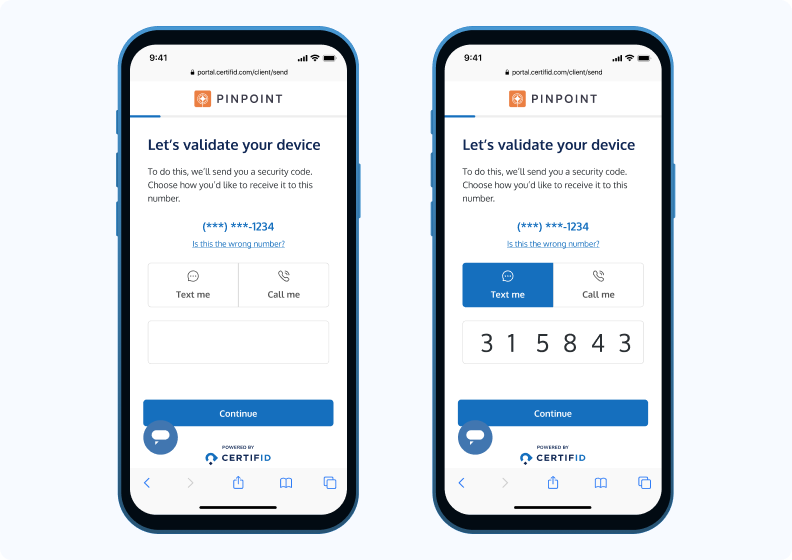

3. You validate your device with a security code

CertifID sends a one-time security code to your phone via text or call. Enter the code to confirm you are who you say you are. This multi-factor authentication step ensures that even if someone intercepts your email, they cannot access your wiring instructions without also having access to your phone.

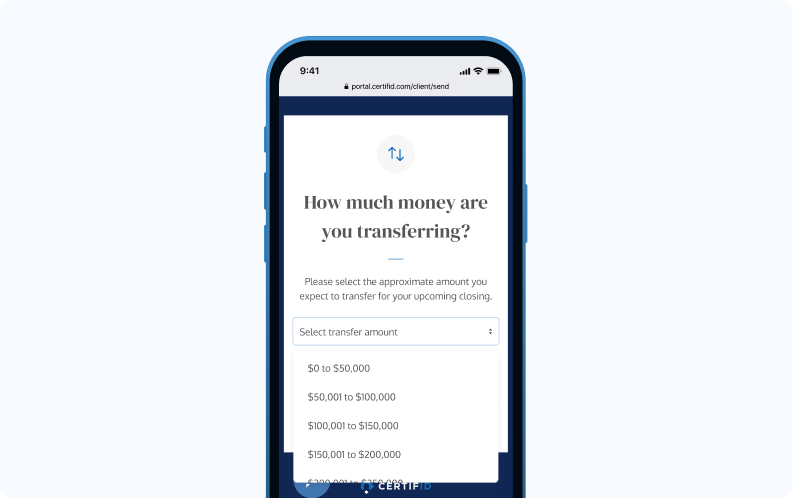

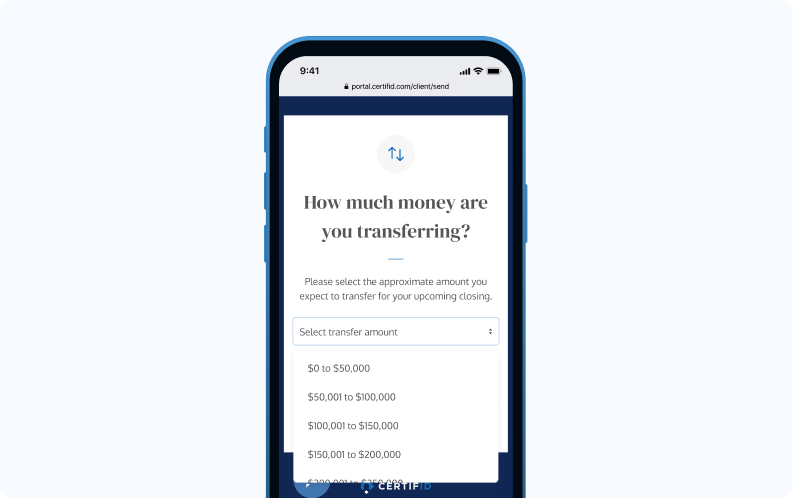

You select your approximate transfer amount

Choose the range that best matches your expected wire transfer. If you are unsure of the exact amount, select the closest option. Your title company or lender will confirm the final figure on your closing disclosure.

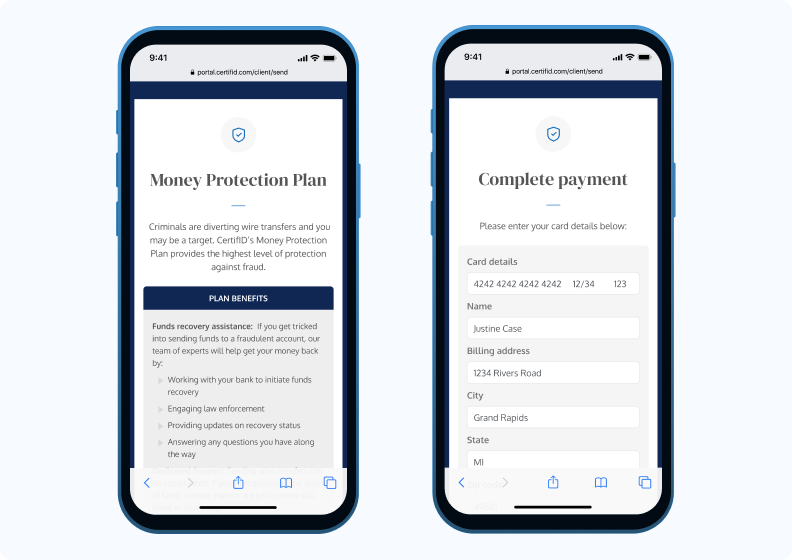

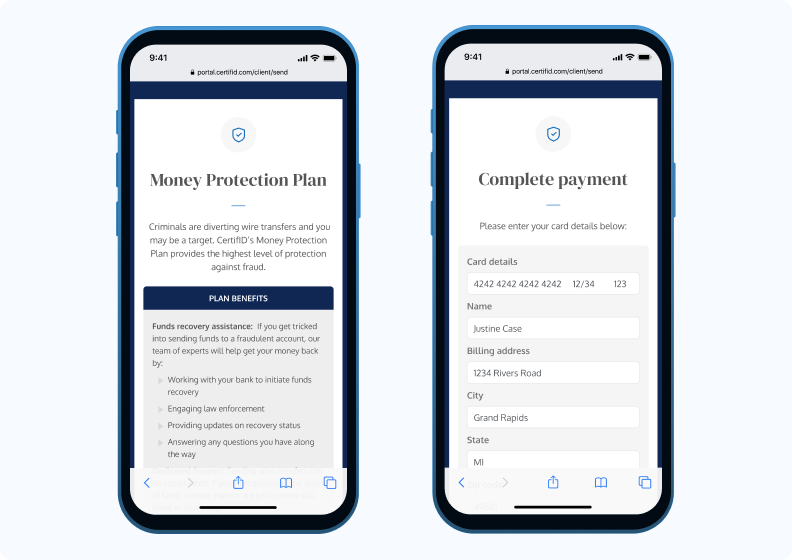

You can purchase additional protection (optional)

CertifID offers a Money Protection Plan that provides funds recovery assistance if you are ever tricked into sending money to a fraudulent account.

The plan includes a dedicated team that works with your bank and law enforcement to help recover your funds. This is an optional add-on for buyers who want extra peace of mind.

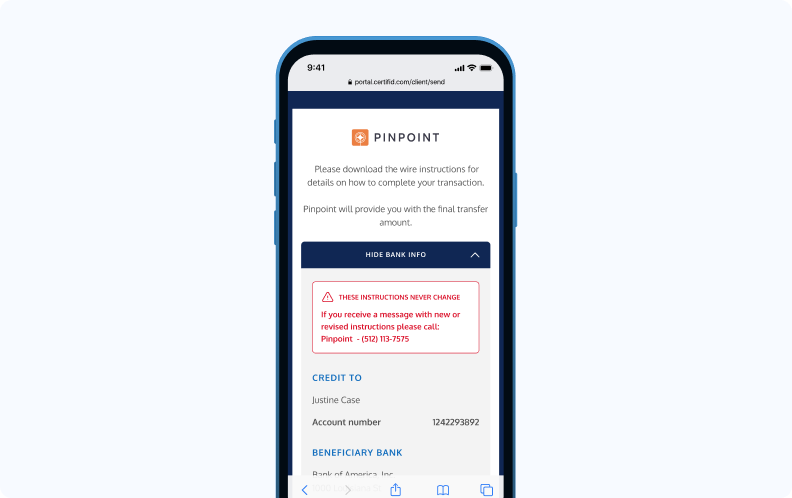

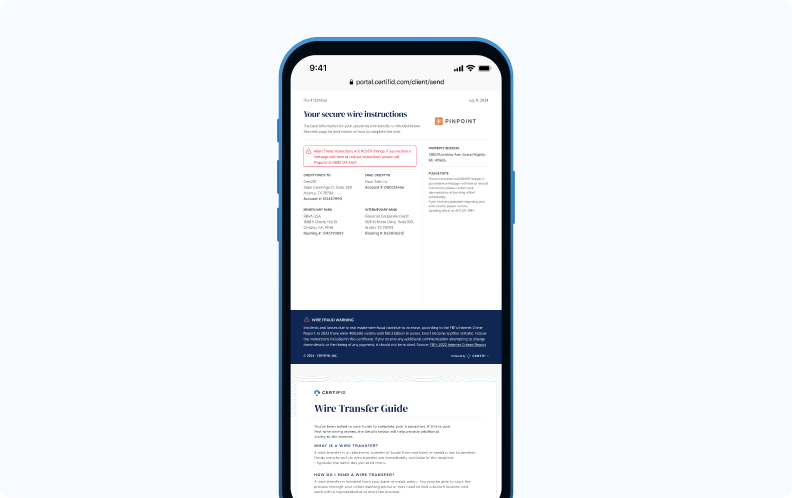

You receive your verified wiring instructions

Download the PDF containing your title company's bank name, account number, and routing number. The document includes a clear warning: these instructions will never change.

If anyone contacts you with "updated" or "revised" instructions, call your title company immediately using the phone number provided in the PDF—not a number from a new email.

By completing this process, you can be confident that the wiring instructions you receive are legitimate and protected.

Ask your title company or real estate attorney if they use CertifID

If they do not, consider requesting that they adopt this fraud prevention standard to protect your transaction. Your home purchase is likely the largest financial transaction of your life—it deserves the highest level of protection.

What to do if you're a victim of wire fraud

Even with precautions, fraud attempts occur. If you suspect you have been targeted, do not delay. Fraudsters move funds quickly, so immediate action is necessary.

Immediate actions if fraud is suspected:

- Contact your bank immediately: Provide them with the EFT receipt and request a "SWIFT recall" on the transfer

- File a complaint with the FBI's Internet Crime Complaint Center (IC3): Submit all information regarding the incident, including actions taken by you and your bank

- Notify your title company and real estate agent: Alert them to the fraud attempt

- Document all communications: Keep records of emails, receipts, and interactions

Recovery expectations: Recovery is not guaranteed. The faster you act, the higher the chance of success. Specialized wire fraud recovery services can assist, but time is critical.

FAQ

Can I reverse a wire transfer if I sent it to the wrong account?

No. Wire transfers are immediate and cannot be reversed once initiated. This makes verifying wiring instructions critical. If you suspect fraud, contact your bank immediately to request a SWIFT recall.

How long does a wire transfer take for closing?

Most domestic wire transfers arrive within the same or next business day. Transfers initiated late in the day, on weekends, or during holidays may take longer. Plan to send your wire 1-2 days before closing.

Do I have to wire money, or can I use a cashier's check?

While cashier's checks are accepted in some areas, wire transfers are preferred for large real estate transactions due to their speed and traceability. Confirm the preferred payment method with your title company.

How much does it cost to wire money for closing?

Banks typically charge $25-$75 for outgoing domestic wire transfers. Some banks waive fees for large transactions or premium account holders. Verify fees with your bank before initiating the transfer.

What is a Federal Reference number and why do I need it?

A Federal Reference number (or "fed ref") is a 16-20 digit tracking number assigned to your wire transfer. It allows you and your title company to track and verify the wire. Keep this number with your receipt and bring it to closing.

What should I do if I receive "updated" wiring instructions?

Treat any changes to wiring instructions with extreme caution. This is a common fraud tactic. Always verify changes by calling your title company directly using a phone number you obtained independently. Never send money until you confirm changes verbally.

VP of Customer Success

Katie's background combines both IT and education. Her degree is in Management Information Systems, and she spent her first four years in the workforce as an IT business analyst. Katie took a career turn and joined Teach for America and worked in inner-city schools in Indianapolis as a math teacher and eventually an assistant principal. Today she combines her IT nerdiness and love of teaching, helping customers find success every day.

Purchasing a home is the culmination of months of effort—comparing options, making offers, scheduling inspections, and securing financing. When it's finally time to close, you need to be prepared to send your Cash to Close payment and seal the deal.

The most efficient way to close is by wiring money electronically. We have moved past the days of handwritten checks or carrying cash to the closing table. But according to the FBI's 2024 Internet Crime Report, real estate wire fraud resulted in over $446 million in losses.

Wire transfers are a secure way to send large sums of money, provided you take specific precautions. Understanding the process and coordinating with your bank will help make this part of the transaction straightforward.

What is a wire transfer and why use it for closing?

A wire transfer—sometimes referred to as a bank transfer, credit transfer, or EFT (Electronic Funds Transfer)—is an electronic movement of money from one financial institution to another. It is a fast way to send funds, as the money is typically available for immediate use within the same or next day.

The SWIFT (Society for Worldwide Interbank Financial Telecommunication) or Fedwire networks are typically used for these transfers, allowing for both international and domestic transactions.

Wire transfers are preferred over checks for real estate closings because they provide speed, verification, and certainty.

Checks can bounce or face delays, but wire transfers are immediate and permanent once processed. Both parties in the transaction must be account holders at their respective institutions. Reputable banks verify a new account holder's identity when opening an account, which adds a layer of protection.

When you'll need to wire money: EMD vs. Cash to Close

There are two points in the home-buying process where you will need to send large sums of money: the Earnest Money Deposit (EMD) and the Cash to Close payment.

An EMD is a deposit you put down to demonstrate your intent to buy the home. This is typically 1% to 3% of the total purchase price. Unlike the down payment paid at closing, the EMD is credited toward your down payment later in the process.

Cash to Close includes your down payment, closing costs, and any other fees, minus credits like your earnest money deposit. Both amounts will vary based on the terms set between you and the title or escrow company. The same wire transfer process applies to both EMD and closing funds.

Now, you’ll check 6 steps to make sure the transaction is successful and safe.

Step 1: Get and verify your wire transfer instructions

You will typically receive these instructions from your title company 2-3 days before closing. The instructions will include the title or escrow company's financial institution name, account number, and routing number or ABA (American Bankers Association) number.

Key insight: Fraud often involves a criminal sending "updated" or "new" wiring instructions to direct funds to a fraudulent account. Always check in with your title company to confirm any changes before proceeding.

Step 2: Confirm your exact cash-to-close amount

Review your closing disclosure carefully to ensure you account for every detail. Cash to Close includes your down payment, closing costs, and fees, minus credits.

Compliance note: If you receive an updated closing disclosure with changes to your Cash to Close amount after initiating a wire, contact both your title company and bank immediately. You may need to send an additional wire for the difference or receive a credit at closing.

Step 3: Initiate the wire transfer through your bank

You can typically initiate a wire transfer through three methods:

- In-person at your bank branch

- Phone with a bank representative

- Online through your bank's portal

Many banks require in-person visits for large sums involved in real estate closings. They may charge a fee of $25-$75 for wiring money. Some banks waive fees for large transactions or premium account holders, so ask about fees when contacting your bank.

You will need the details of the account you are sending money from.

If you do not have this on hand, you can find it online, through your bank's mobile app, or by calling your bank. You will also need a government-issued ID for in-person transfers. Confirm with your bank that the funds are available to transfer. If the money is not available, you will not be able to close.

Step 4: Double-check all wire transfer details before sending

This is your final opportunity to ensure all information is correct before funds leave your account. Verify every digit in the account and routing numbers against your written instructions. Wire transfers cannot be reversed once initiated, so accuracy is critical.

Ask to have the address of the property you are purchasing added to the notes section of the wire transfer summary. This gives the title company more context for the payment when they receive it.

Step 5: Send the wire transfer

Plan to send your wire 1-2 days before closing to ensure funds arrive on time. Wire transfers generally arrive on the same day they are sent, but may arrive the following business day if initiated later in the day. Processing times may extend during holidays or weekends.

Step 6: Confirm receipt and save your federal reference number

Once you send the wire, you will receive a receipt. Keep this record and bring it to closing. The money moves from your bank to a correspondent bank before reaching the recipient.

Federal Reference number: Request the Federal Reference number or "fed ref" number from your bank. This is a 16-20 digit tracking number found on the wire transfer receipt. It tracks the wire like a package in the mail and helps identify it when referencing it with your title or escrow company.

Call the title or escrow company to confirm the transfer and ensure delivery. Provide the exact amount of the wire and the federal reference number to verify the match.

Protect yourself: Final checklist for secure wire transfers

Quick checklist: Wiring money for closing

[ ] Receive wiring instructions from title company

[ ] Review closing disclosure for exact amount

[ ] Contact bank 1-2 days before closing

[ ] Verify all account numbers and routing numbers

[ ] Send wire and obtain Federal Reference number

[ ] Confirm receipt with title company

Recommended timeline:

- 3 days before closing: Receive closing disclosure

- 2 days before closing: Contact bank, verify instructions

- 1 day before closing: Send wire transfer

- Closing day: Confirm receipt, bring wire receipt

While the process of collecting information and sending money is straightforward, criminals actively target these large transactions. Always verify information at each stage and maintain communication with your title or escrow company.

How to verify wiring instructions with CertifID

Many reputable title companies and law practices now use CertifID as a fraud prevention standard in closings.

According to CertifID's State of Wire Fraud 2025 report, over 1 in 4 home buyers and sellers are targeted by fraudsters during their transaction.

If your title company uses CertifID, you will receive your wiring instructions through a secure, verified channel—not through email, which can be intercepted or spoofed by criminals.

The process takes just a few minutes and does not require you to create an account or remember any passwords.

Here is what to expect when your title company sends you a CertifID request.

1. You receive an email and text message.

The message will come from CertifID on behalf of your title company. It will include a personalized note from your closing agent and a secure link to access your wiring instructions. You can complete the process on your phone or computer—whichever is more convenient.

2. CertifID secures the connection and analyzes your device

When you click "Get Started," CertifID analyzes your device for over 150 fraud indicators before proceeding.

This includes checking whether the device is located outside the United States, whether it was recently activated (like a burner phone), and other signals associated with fraudulent activity. If anything looks suspicious, the process stops immediately.

3. You validate your device with a security code

CertifID sends a one-time security code to your phone via text or call. Enter the code to confirm you are who you say you are. This multi-factor authentication step ensures that even if someone intercepts your email, they cannot access your wiring instructions without also having access to your phone.

You select your approximate transfer amount

Choose the range that best matches your expected wire transfer. If you are unsure of the exact amount, select the closest option. Your title company or lender will confirm the final figure on your closing disclosure.

You can purchase additional protection (optional)

CertifID offers a Money Protection Plan that provides funds recovery assistance if you are ever tricked into sending money to a fraudulent account.

The plan includes a dedicated team that works with your bank and law enforcement to help recover your funds. This is an optional add-on for buyers who want extra peace of mind.

You receive your verified wiring instructions

Download the PDF containing your title company's bank name, account number, and routing number. The document includes a clear warning: these instructions will never change.

If anyone contacts you with "updated" or "revised" instructions, call your title company immediately using the phone number provided in the PDF—not a number from a new email.

By completing this process, you can be confident that the wiring instructions you receive are legitimate and protected.

Ask your title company or real estate attorney if they use CertifID

If they do not, consider requesting that they adopt this fraud prevention standard to protect your transaction. Your home purchase is likely the largest financial transaction of your life—it deserves the highest level of protection.

What to do if you're a victim of wire fraud

Even with precautions, fraud attempts occur. If you suspect you have been targeted, do not delay. Fraudsters move funds quickly, so immediate action is necessary.

Immediate actions if fraud is suspected:

- Contact your bank immediately: Provide them with the EFT receipt and request a "SWIFT recall" on the transfer

- File a complaint with the FBI's Internet Crime Complaint Center (IC3): Submit all information regarding the incident, including actions taken by you and your bank

- Notify your title company and real estate agent: Alert them to the fraud attempt

- Document all communications: Keep records of emails, receipts, and interactions

Recovery expectations: Recovery is not guaranteed. The faster you act, the higher the chance of success. Specialized wire fraud recovery services can assist, but time is critical.

VP of Customer Success

Katie's background combines both IT and education. Her degree is in Management Information Systems, and she spent her first four years in the workforce as an IT business analyst. Katie took a career turn and joined Teach for America and worked in inner-city schools in Indianapolis as a math teacher and eventually an assistant principal. Today she combines her IT nerdiness and love of teaching, helping customers find success every day.

Sign up for The Wire to join the conversation.

.png)